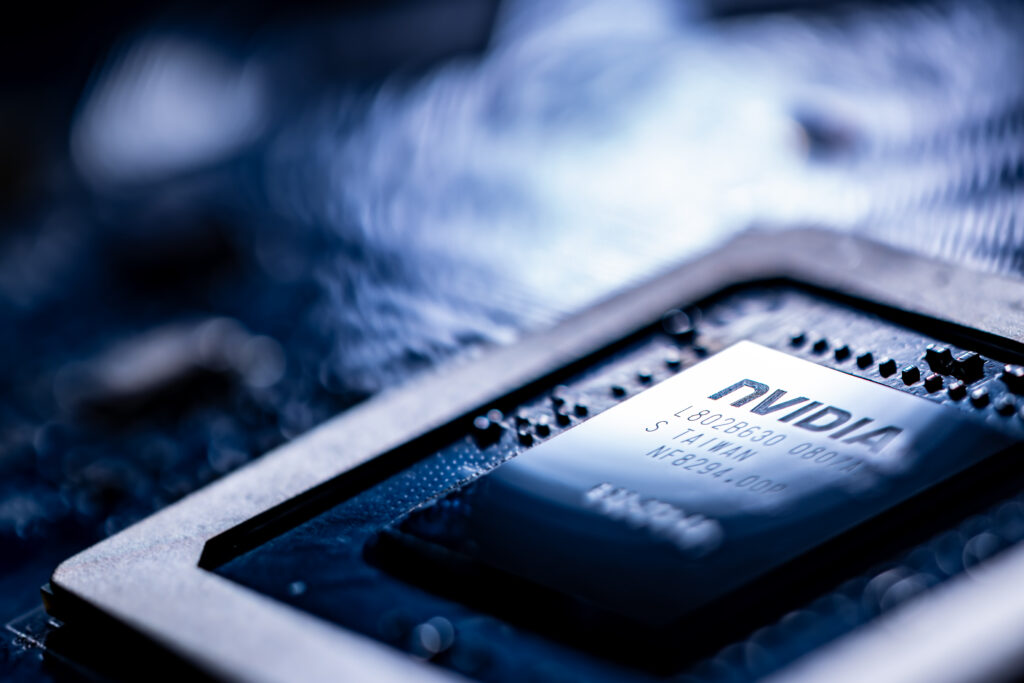

Stocks steadied Wednesday following heavy losses as investors awaited Nvidia earnings for further clues about whether AI-fueled valuations are justified.The S&P 500 and Nasdaq rose in New York, while most European stock markets closed marginally lower. Oil prices slumped, while Bitcoin slipped below $90,000 and the dollar strengthened.”The selling pressure had moderated from Monday (but) investors were unwilling to add to their overall exposure ahead of tonight’s earnings update from chip giant Nvidia,” said David Morrison, senior market analyst at Trade Nation.Investors have endured a tough November as speculation grew that the tech-led rally this year may have gone too far, and valuations have become frothy enough to warrant a stiff correction.With the Magnificent Seven — also including Amazon, Meta, Alphabet and Apple — powering recent record highs on Wall Street, there are worries that a change in sentiment could have huge ripple effects on markets.Chip giant Nvidia is the biggest of the bunch, last month becoming the first $5-trillion company. It will report third-quarter results after the market shuts.”The slightest bit of news to disappoint investors has the potential to whip up a tornado across global markets,” said Russ Mould, investment director at AJ Bell.Nvidia shares closed 2.9 percent higher in New York before the release of its report.Investors are nervous that any sign of weakness could be the pin that pops the artificial intelligence bubble, having spent months fearing that the hundreds of billions invested may have been excessive.A Bank of America survey of fund managers found that more than half thought AI stocks were already in a bubble and 45 percent thought that to be the biggest “tail risk” to markets, more so than inflation.That came after the BBC released an interview with the head of Google’s parent company Alphabet — Sundar Pichai — who warned every company would be hit if the AI bubble were to burst.Investors on Wednesday also digested meeting minutes from the Federal Reserve’s late-October gathering, which showed “many” officials leaning towards keeping interest rates unchanged in December.Such an outcome would likely anger US President Donald Trump, however, who said Wednesday that he would “love to fire” Fed Chair Jerome Powell.Meanwhile, US retailer Target blamed sluggish consumer spending for its disappointing report early Wednesday and more indications of the state of the real economy will come from Walmart’s earnings expected Thursday morning. Target shares were down 2.8 percent.In Paris, Air France shares were up 3 percent after officially expressing interest in taking a stake in Portuguese carrier TAP.Oil prices fell sharply as reports of higher US reserves outweighed any concern over Ukrainian attacks on Russian oil installations.- Key figures at around 2105 GMT -New York – Dow: UP 0.1 percent at 46,138.77 points (close)New York – S&P 500: UP 0.4 percent at 6,642.19 (close)New York – Nasdaq Composite: UP 0.6 percent at 22,564.23 (close)London – FTSE 100: DOWN 0.5 percent at 9,507.41 (close)Paris – CAC 40: DOWN 0.2 percent at 7,953.77 (close)Frankfurt – DAX: DOWN 0.1 percent at 23,162.92 (close)Tokyo – Nikkei 225: DOWN 0.3 percent at 48,537.70 (close)Hong Kong – Hang Seng Index: DOWN 0.4 percent at 25,830.65 (close)Shanghai – Composite: UP 0.2 percent at 3,946.74 (close)Euro/dollar: DOWN at $1.1526 from $1.1580Pound/dollar: DOWN at $1.3048 from $1.3146Dollar/yen: UP at 157.01 yen from 155.53 yen Euro/pound: UP at 88.33 from 88.09 penceBrent North Sea Crude: DOWN 2.1 percent at $63.51 per barrelWest Texas Intermediate: DOWN 2.1 percent at $59.44 per barrel