TV5 Monde ressuscite les speakerines cet hiver

Disparus en France au début des années 90, les speakerines et speakers, présentateurs qui introduisaient les programmes à la télé, font leur retour cet hiver sur TV5 Monde, a annoncé la chaîne jeudi.Ces speakerines et speakers présenteront de courtes pastilles intitulées “La pause” et conçues “comme une respiration entre les programmes et les écrans publicitaires, mêlant humour et spontanéité”, indique TV5 Monde dans un communiqué, en détaillant de premières annonces faites en septembre.”+La pause+ accompagnera le public en lui présentant ce qu’il pourra voir ensuite à l’antenne et sur la plateforme de streaming TV5Monde”, poursuit la chaîne internationale. Elle sera diffusée sur les chaînes de TV5 Monde en Europe à partir de cet hiver, puis étendue à tous les continents au printemps 2026.”Dans l’esprit originel des speakerines, qui n’avaient pas d’expérience préalable de la présentation, “La pause” sera incarnée par des salariés qui feront leurs tout premiers pas à l’écran”, souligne la chaîne.Pour cela, un appel aux volontaires a été lancé, qui donnera lieu à “un casting début novembre”. En France, les speakerines (fonction quasi-exclusivement féminine) sont apparues dès l’essor de la télévision au début des années 50.Au fil des ans, ces figures familières des téléspectateurs ont parfois accédé au rang de vedettes, comme Jacqueline Joubert et Catherine Langeais dans les années 50/60, Denise Fabre, Evelyne Dhéliat ou Evelyne Leclercq dans les années 70, puis Carole Varenne dans les années 80.Quelques rares hommes ont occupé cette fonction, comme Olivier Minne au début des années 90.C’est à cette époque que les speakerines et speakers ont disparu de l’antenne, remplacés par des voix off.Selon TV5 Monde, leur retour vise à “renforcer le lien direct et chaleureux avec les téléspectateurs”.Présidée par Kim Younes depuis octobre 2024, TV5 Monde est une chaîne francophone publique multilatérale, financée par la France, la Suisse, le Canada, le Québec, la Belgique et Monaco. Elle diffuse huit signaux distincts selon les zones de la planète auxquelles elle s’adresse.

Vingt ans après, le souvenir de Zyed et Bouna au cœur de Clichy-sous-Bois

En octobre 2005, la mort de deux adolescents à Clichy-sous-Bois déclenchait une vague d’émeutes entrée dans l’Histoire. Vingt ans après, la ville est métamorphosée mais des jeunes du même âge s’y demandent encore si eux aussi ne pourraient pas courir un jour, “par peur de la police”.A 17 kilomètres de Paris, Clichy-sous-Bois est jeune, très jeune: 40% de ses 30.000 habitants n’ont pas encore 20 ans.La plupart des adolescents rencontrés dans différents quartiers connaissent pourtant l’essentiel du drame du 27 octobre 2005 quand, après avoir été coursés par des policiers, Bouna Traoré, 15 ans, et Zyed Benna, 17 ans, se cachèrent dans un site EDF et y furent électrocutés. Serrés sur un banc devant l’Hôtel de ville, se taquinant tout en scrollant sur leur téléphone, trois amis passent de la joie à la gravité à leur évocation.”Ils étaient comme moi, ils aimaient le foot, ils travaillaient à l’école, le collège où je vais”, dit Karamoko, né il y a 15 ans en Seine-Saint-Denis de mère mauritanienne et père sénégalais, le regard limpide derrière des lunettes stylées. “Ils ont eu peur de la police, ils ont fui. Je crois que j’aurais fait pareil mais que je ne me serais pas réfugié là”.Cet après-midi de vacances scolaires de 2005, la police est appelée pour une suspicion de vol par des enfants sur un chantier – qui n’a en réalité pas eu lieu. Des agents pourchassent alors des adolescents qui se sont dispersés à leur vue, bien qu’ils n’aient rien à se reprocher, à leur retour d’un match de foot dans une ville voisine, faute de stade dans la leur. Paniqués, trois des ados vont jusqu’à escalader les hautes clôtures d’un site EDF, se cachent une demi-heure dans un local à haute tension. Des décharges de 20.000 volts seront mortelles.Vingt ans après, l’histoire de Zyed et Bouna “fait toujours mal au coeur”, dit Sacha, 17 ans, devant son lycée qui s’allonge à moins de 300 mètres du tout premier commissariat de police de la ville, inauguré en 2010.Si Sacha et Michael n’ont pas eu affaire aux policiers, et vante “la bonne ambiance” d’une ville “où on est tous ensemble”, leur ami Bulent a subi plusieurs contrôles: “aujourd’hui encore il y a beaucoup de discriminations”, dit-il. “Si les +keufs+ voient des Blancs, ils ne vont pas les contrôler, mais le feront si ce sont des Arabes ou des Noirs”.”Courir par peur de la police, ça pourrait encore arriver”, glisse Safiatou, 17 ans, à leurs côtés.Plus loin, Stanley, 14 ans, raconte son “seul rapport avec la police” avec un reste d’étonnement inquiet: “On sortait des cours, les policiers nationaux ont sauté sur nous et même plaqué mon pote. Ils ont laissé repartir les Blancs, n’ont contrôlé que des Noirs et des Arabes”.Face aux hautes tours de la cité du Bois-du-temple récemment rénovées, Adem, 15 ans, dit, lui, avoir “confiance” dans la police. “Mais il y a toujours des policiers qui font des bavures, on le voit sur les réseaux, et le réflexe des jeunes, ça peut être de fuir pour éviter ça. Moi en tout cas je ne courrais pas. Mes parents m’ont dit de ne surtout pas courir”.- “La révolte a commencé là” -La mort de Zyed et Bouna puis le fait que les autorités aient d’abord nié la réalité de la course-poursuite en évoquant à tort une tentative de cambriolage, servirent de détonateurs aux émeutes.Elles ne durèrent que quelques nuits à Clichy-sous-Bois mais trois semaines dans le pays, finalement placé sous état d’urgence. Fin 2005, un rapport des renseignements généraux décrivait “une révolte populaire des cités, sans leader”.Au cœur du quartier du Chêne-Pointu où tout commença, d’ex-émeutiers s’en souviennent comme d’un point de bascule dans leur vie. Même s’ils n’habitent plus la ville, plusieurs se rassemblent souvent en fin de journée sur un parking, pour discuter ou fumer ensemble. “C’est notre zone de confort, d’anciens +jeunes du béton+”, dit Fiston Kabunda, 44 ans, aujourd’hui employé de la mairie. Le 27 octobre 2005, devant la barre voisine, ils virent revenir Muhittin, rescapé du transformateur, brûlé, vêtement déchirés. “On a dit +Eh, petit, qu’est-ce qui se passe ?+ Il a répondu que les deux autres étaient coincés là-bas dans le transfo, que les keufs les avaient coursés”, raconte anonymement Paul, 40 ans, gérant de salon de coiffure.Fiston fut alors celui qui appela les pompiers.”Quand les corps ont été sortis du transfo, nos cœurs ont explosé”, résume Paul. Plus tard, “la première voiture de police remontée dans le quartier a été caillassée. La révolte a commencé là, devant la barre où Zyed habitait”.”Il fallait qu’on casse, qu’on brûle, on ne savait plus comment exprimer notre colère, on s’est exprimés avec les codes de la rue”, assume Fiston.Plusieurs voix résument “le sentiment” dominant alors: “c’était +l’Etat nous délaisse, donne les pleins pouvoirs aux forces de l’ordre pour nous rabaisser, nous faire comprendre qu’on n’est rien chez eux+”. Le contexte, ajoute Paul, “c’était (le ministre de l’Intérieur Nicolas) Sarkozy qui voulait nettoyer les cités +au karcher+ et parlait de +la racaille+, toute la tension entre la banlieue et, disons, la classe dirigeante”.- “Filles et fils de la République” -Le 14 novembre 2005, trois jours avant la fin des émeutes, le président Jacques Chirac déclarait solennellement: “Je veux dire aux enfants des quartiers difficiles (…) qu’ils sont tous les filles et les fils de la République”. Appelant à combattre “le poison” des discriminations”, il évoquait aussi “l’urbanisme inhumain” des cités.Plus d’un milliard d’euros auront été dépensés localement en vingt ans pour de vastes programmes de “renouvellement urbain”, selon le maire (divers gauche) de Clichy-sous-Bois, Olivier Klein (ex-ministre de la Ville en 2022-2023).”Le premier programme Anru (Agence nationale pour la rénovation urbaine) avait été signé en décembre 2004, avant la mort des deux enfants. Mais après les révoltes de 2005, plus personne ne pouvait ignorer que dans ce pays il y avait des lieux d’extrême fracture sociale territoriale, dans lesquels il fallait investir de manière très, très importante”, commente M. Klein, évoquant aussi l’arrivée du métro prévue en 2027, “qui aurait été probablement inatteignable si les projecteurs n’avaient pas été braqués sur ces quartiers-là”.Les jeunes Clichois sont aujourd’hui nombreux à dire que la ville a “changé en bien”, listant les nouveaux équipements – tramway, stades, terrains de sports, piscine, bibliothèque, Maison de la jeunesse… et l’impressionnant conservatoire d’où s’échappent des notes de piano.Restent les vastes copropriétés ultra-dégradées du Chêne-Pointu – décor en 2018 du film de Ladj Ly “Les Misérables” – également promises à de prochaines démolitions-reconstructions. “Les émeutes ont-elles servi ? Oui et non… La ville et la jeunesse venue après ont quand même eu quelque chose de gratifiant, des infrastructures et tout”, admet Paul, pour qui le sentiment d’abandon s’est dissipé mais pas celui de discriminations latentes envers les banlieusards enfants d’immigrés.”Ici, c’est le bas Clichy: il y a toujours le même cycle de pauvreté”, constate aussi Fiston, la ville restant décrite par la Cour des comptes comme “la troisième commune de France continentale la plus pauvre”. Lui, insiste sur des “soucis encore avec les forces de l’ordre qui ne sont pas du département ni d’Ile-de-France”, et “le délit de faciès qui existe toujours”.- “Le lien police-population” -Cependant, la ville “ne demande pas moins de police mais davantage”, selon la mairie, quand des habitants déplorent toujours du “business” (trafic de stupéfiants) au pied des immeubles.Au moins, “les émeutes dans tout le pays en 2005 avaient réveillé un peu les Français”, conclut l’adolescent Adem: “Ce n’est pas de cette manière qu’il faut se rebeller, mais après tout ce bazar, il y avait eu une enquête, un procès”, ajoute-t-il, tout en regrettant que deux policiers jugés neuf ans plus tard pour non-assistance à personne en danger n’aient pas été condamnés.Quinze ans après l’inauguration du commissariat, présenté comme “un symbole du réengagement de l’Etat dans un secteur jusque-là éloigné de toute implantation policière”, l’AFP n’a pas été autorisée à y rencontrer un interlocuteur. Mais la préfecture de police (PP) souligne par écrit que “la police nationale conserve elle aussi un souvenir précis de ces événements (de 2005), des critiques qui ont accompagné son action, de ses blessés et des efforts déployés pour rétablir l’ordre”.”Bien qu’aucun policier actuellement en poste au commissariat” ne les ait vécus, “tous partagent la volonté qu’ils ne se reproduisent pas”, ajoute la PP, assurant que la police nationale “s’est investie sans réserve pour reconstruire le lien police-population”, notamment à travers son centre de loisirs jeunesse animé par des policiers volontaires.En mémoire de Zyed et Bouna, un arbre sera planté lundi en face de leur collège, en présence de leurs familles, et l’association Au-delà des mots organisera le 2 novembre un tournoi sportif.Pour le président de cette assocation, Samir Mihi, “le visage de la ville a énormément changé”. Mais pour cet enseignant de 48 ans, “il reste pas mal de travail contre les discriminations et la précarité sociale”.

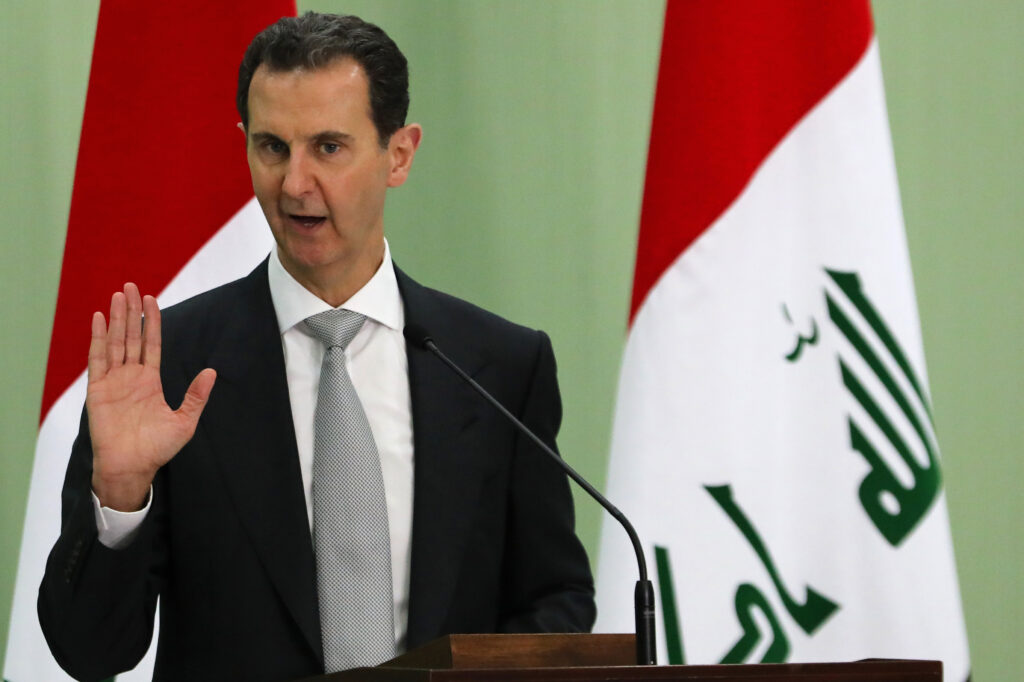

Un troisième mandat d’arrêt délivré à Paris contre Bachar al-Assad

Un nouveau mandat d’arrêt international a été délivré cet été à Paris contre Bachar al-Assad pour des attaques chimiques mortelles en 2013, portant à trois le nombre de mandats émis par la justice française contre l’ex-président syrien exilé en Russie.Le mandat d’arrêt, pour complicité de crimes contre l’humanité et complicité de crimes de guerre, a été signé le 29 juillet par des juges d’instruction parisiens, a indiqué jeudi à l’AFP une source judiciaire. Soit quelques jours seulement après l’annulation d’un premier mandat dans ce dossier.La Cour de Cassation avait annulé le 25 juillet, au nom de l’immunité absolue d’un chef d’Etat en exercice, ce mandat délivré en novembre 2023, M. Assad dirigeant alors toujours la Syrie.Mais la plus haute juridiction de l’ordre judiciaire français avait précisé que d’autres mandats pourraient suivre, l’ex-dictateur ayant été renversé le 8 décembre 2024.Le jour même, le Parquet national antiterroriste (Pnat), compétent en matière de crimes contre l’humanité, avait requis un nouveau mandat d’arrêt.Les attaques chimiques attribuées au régime syrien ont été menées le 5 août à Adra et Douma (450 blessés), puis le 21 août 2013 dans la Ghouta orientale (plus de mille personnes tuées au gaz sarin, selon les renseignements américains).Dans le dossier, un mandat d’arrêt a par ailleurs été délivré le 16 juillet à l’encontre de Talal Makhlouf, ancien commandant de la 105e brigade de la Garde républicaine syrienne, a indiqué la source judiciaire.Maher al-Assad, frère du président déchu et chef de facto de la 4e division blindée syrienne au moment des faits, ainsi que deux généraux, Ghassan Abbas et Bassam al-Hassan, sont également visés par des mandats depuis novembre 2023.Sollicitées par l’AFP, Jeanne Sulzer et Clémence Witt, avocates de la coalition d’ONG parties civiles dans le dossier – Centre syrien pour les médias et la liberté d’expression (SCM), PHR, OSJI, Mnemonic, CRD et WND – et de plusieurs victimes, ont salué ce nouveau mandat d’arrêt.Depuis l’émission du premier, les victimes “n’ont cessé d’appeler à sa diffusion rapide et effective aux niveaux européen et international, et à l’utilisation effective des mécanismes de coopération”, ont-elles souligné. “Elles espèrent que les autorités françaises agiront de manière proactive et efficace pour éviter que Bachar al-Assad échappe à la justice et que ces crimes restent impunis”, ont-elles ajouté.- Centre de presse bombardé -Deux autres mandats délivrés par la justice française visent l’ancien dictateur.L’un a été émis le 20 janvier 2025 pour complicité de crime de guerre, pour le bombardement d’une zone d’habitations civiles à Deraa (sud-ouest) en 2017.Un autre, pour complicité de crimes de guerre et de crimes contre l’humanité, a été signé le 19 août et concerne le bombardement en 2012 d’un centre de presse à Homs (centre), dans lequel ont péri la reporter américaine du Sunday Times Marie Colvin et le photographe français Rémi Ochlik.La journaliste française Edith Bouvier, le photographe britannique Paul Conroy et leur traducteur syrien Wael al-Omar avaient été blessés.Dans le dossier, les juges d’instruction ont aussi délivré des mandats d’arrêt visant six ex-hauts gradés, notamment Maher al-Assad et Ali Mamlouk, alors directeur des renseignements généraux syriens.- 17 ex-responsables visés -Contactée par l’AFP, Me Clémence Bectarte, avocate de la Fédération internationale des droits humains (FIDH), du SCM et de la famille de Rémi Ochlik, a souligné que ces trois mandats “reflètent différents aspects de la répression menée par Bachar al-Assad”.”A la fois contre sa propre population, avec les attaques chimiques et le fait de cibler délibérément la population civile à Deraa. Mais aussi une répression délibérée contre les journalistes, avec pour objectif qu’ils quittent le terrain afin de ne plus pouvoir rendre compte des crimes perpétrés par le régime”, a-t-elle estimé.Au total, a-t-elle précisé, 17 officiels de l’ancien régime syrien sont visés par des mandats en France, dans quatre dossiers: les trois déjà cités, ainsi que la disparition forcée et la mort de deux citoyens franco-syriens, Mazzen Dabbagh et son fils Patrick, arrêtés en 2013.L’ancien homme fort de Damas pourrait être jugé en France, même en son absence si, à l’issue des informations judiciaires, les juges d’instruction ordonnent un procès contre lui.

Thales: Iris² dope les commandes et sauve des emplois dans le spatial

Le contrat lié à la future constellation européenne de satellites Iris² a contribué au 3e trimestre au bond des commandes du groupe de haute technologie Thales, jusqu’ici porté surtout par la défense, assurant l’arrêt des suppressions de postes dans la branche spatiale.Thales, qui vient parallèlement d’annoncer la signature d’un accord avec l’européen Airbus et l’italien Leonardo pour fusionner ses activités spatiales, a détaillé jeudi ce contrat d’un montant de plus de 100 millions d’euros.Il marque la première phase d’ingénierie du projet de constellation Iris² (prononcé Iris Square), clé pour la sécurité européenne et la relance d’un secteur de satellites de communications affaibli par la domination de Starlink, la méga-constellation d’Elon Musk.”Pour la première fois, nous avons pu signer un contrat de taille très significative avec SpaceRise”, le consortium des trois opérateurs de satellites chargé du déploiement en 2030 d’Iris², un réseau de près de 300 satellites pour la connectivité sécurisée, a déclaré Pascal Bouchiat, directeur financier de Thales, au cours d’une conférence de presse téléphonique. – “Dégradation de la santé” -Interrogé par l’AFP, il a confirmé que “compte tenu du projet Iris²”, la suppression de postes dans sa branche spatiale avait été “suspendue”, après avoir déjà redéployé 75% de salariés. En juin, le groupe avait déjà fait état d’un “ralentissement” de la mise en œuvre de son “plan d”adaptation” lancé en mars 2024 et concernant 1.300 salariés dans le spatial dont 980 en France. L’annonce de ce contrat intervient dans un contexte social tendu : la CGT de Thales Alenia Space a assigné la direction en justice, dénonçant une “dégradation de la santé des salariés” liée au plan de suppressions de postes.Le tribunal de Toulouse rendra sa décision le 15 décembre, après l’audience tenue le 20 octobre.Le syndicat demande au juge d’imposer à la direction l’arrêt “complet et définitif” de ce plan ainsi qu’un plan d’embauches “à la hauteur de la charge de travail”.”Les accusations portées par la CGT sont infondées et dénuées d’objet, sachant que le plan évolue à un niveau fortement ralenti depuis le premier trimestre 2025. Il a par ailleurs été suspendu pour les équipes travaillant sur les programmes spatiaux”, argumente la direction de Thales dans un communiqué envoyé à l’AFP en assurant que la santé des salariés était une “priorité”.Elle a toutefois rappelé que la demande en satellites de communication avait “été divisée par deux ces cinq dernières années”, ce qui a motivé la réduction des emplois. “L’activité télécom dans le domaine spatial reste sous pression”, a souligné Pascal Bouchiat. “Le fait que nous ayons ce premier contrat de développement sur Iris Square n’enlève pas l’ensemble des challenges auxquels cette industrie fait face en Europe. Starlink n’a pas disparu”, a-t-il ajouté.- Missiles pour plus d’un milliard d’euros -Avec quatre gros contrats engrangés au troisième trimestre, dont trois dans la défense, les commandes de Thales ont progressé de 37% par rapport à la même période de l’année précédente, à 6,4 milliards d’euros, selon un communiqué publié jeudi. Le groupe a notamment décroché un contrat de plus d’un milliard d’euros avec le ministère de la Défense du Royaume-Uni pour la production et la livraison de 5.000 missiles LMM pour un pays tiers.Deux autres commandes de plus de 100 millions d’euros sont celle du ministère allemand de la Défense pour des radars portatifs de surveillance terrestre pour un pays tiers, et d’un autre pays européen pour la livraison de munitions de 70 millimètres.Sur les neuf premiers mois de l’année, les prises de commandes ont également augmenté, de 8%, à 16,8 milliards d’euros.Au troisième trimestre, le chiffre d’affaires a progressé de 9,1%, à 4,95 milliards d’euros. Des éléments qui permettent de “confirmer avec confiance” les objectifs annuels d’une croissance du chiffre d’affaires de 6 à 7% à périmètre et changes constants, dans la fourchette de 21,8 à 22 milliards d’euros, et d’une marge opérationnelle de 12,2 à 12,4%. Vers 11H15, l’action Thales gagnait 1,2% à 262,30 euros à la Bourse de Paris, dans un marché en légère hausse.

Zelensky et l’UE saluent le virage américain sur les sanctions contre Moscou

Le président ukrainien Volodymyr Zelensky et les dirigeants européens ont salué jeudi à Bruxelles la décision des Etats-Unis, exaspérés par l’attitude de Vladimir Poutine, de prendre à leur tour des sanctions contre Moscou.”C’est un message fort et nécessaire indiquant que l’agression (russe contre l’Ukraine) ne restera pas sans réponse”, a-t-il affirmé sur X. “C’est très important”, a-t-il ajouté devant la presse, à son arrivée au sommet des dirigeants de l’UE, quelques heures après l’annonce des deux côtés de l’Atlantique de lourdes sanctions ciblant les hydrocarbures russes.”Nous sommes aussi très heureux des signaux que nous recevons des Etats-Unis”, a souligné en écho la cheffe de la diplomatie européenne Kaja Kallas. “Notre alignement sur ce sujet est un signal important”.La veille, le président américain Donald Trump avait manifesté son impatience envers son homologue russe Vladimir Poutine et annoncé des sanctions qualifiées “d’énormes” contre le secteur pétrolier russe.Le locataire de la Maison Blanche, qui s’est refusé pendant de longs mois à décider de ces sanctions, a estimé que ses conversations avec le président russe n’allaient “nulle part”, au lendemain du report sine die d’une rencontre entre eux envisagée à Budapest.”A chaque fois que je parle avec Vladimir, nous avons de bonnes conversations mais ensuite elles ne vont nulle part”, a-t-il affirmé.Les sanctions impliquent un gel de tous les actifs de Rosneft et Lukoil aux États-Unis ainsi qu’une interdiction à toutes les entreprises américaines de faire des affaires avec les deux géants pétroliers russes.Les cours du brut ont accéléré leur hausse jeudi, à plus de 5%, propulsés par ces annonces, susceptibles de limiter l’offre sur le marché pétrolier.La Russie a dénoncé des sanctions américaines “contre-productives” dont “le résultat sera négatif pour la stabilité de l’économie mondiale”, tout en se disant “immunisée”. La Chine a exprimé son opposition à ces mesures.Les Européens ont également ciblé le secteur pétrolier russe en annonçant mercredi soir un nouveau train de mesures contre Moscou, le 19e depuis l’invasion russe de l’Ukraine en février 2022.Il prévoit notamment un arrêt total des importations de gaz naturel liquéfié (GNL) russe d’ici fin 2026 et des mesures supplémentaires contre la flotte fantôme de pétroliers que Moscou utilise pour contourner les sanctions occidentales.Quelque 117 nouveaux navires de la flotte fantôme russe ont été ciblés, portant à 558 le nombre total de navires sanctionnés par les Européens.Cette pression collective accrue sur Moscou est à même de “changer les calculs” de Vladimir Poutine et de “l’amener à la table des négociations” en vue d’un cessez-le-feu, a estimé le secrétaire général de l’Otan Mark Rutte, reçu mercredi à la Maison Blanche.”J’en suis absolument convaincu, ce ne sera peut-être pas aujourd’hui ni demain, mais nous y arriverons”, a-t-il dit.- Inquiétudes belges -Les Européens entendent de leur côté ne pas relâcher la pression mais aussi ancrer leur soutien dans la durée. Ils comptent pour ce faire prêter 140 milliards d’euros à l’Ukraine en utilisant les avoirs de la banque centrale russe immobilisés dans l’UE.Cette opération totalement inédite n’est pas sans risque, particulièrement pour la Belgique où se trouve l’essentiel de ces avoirs russes en Europe, soit quelque 210 milliards d’euros.Son Premier ministre Bart De Wever a menacé jeudi de bloquer tout le processus s’il n’obtenait pas satisfaction sur les conditions qu’il a posées.”Je veux une mutualisation complète du risque”, a-t-il déclaré dès son arrivée au sommet, soulignant qu’en cas de problème, “les conséquences ne peuvent pas être uniquement pour la Belgique”.Il exige que cette mobilisation des avoirs soit également mise en oeuvre dans les autres pays alliés de Kiev.”Nous savons qu’il y a de vastes sommes d’argent russe dans d’autres pays qui ont toujours gardé le silence à ce sujet”, a-t-il relevé.”Je partage ses préoccupations, mais il souhaite aboutir à une solution commune, et par conséquent, je pense que nous ferons des progrès aujourd’hui (jeudi)”, a affirmé de son côté le chancelier allemand Friedrich Merz.Ces annonces n’ont pas empêché la Russie de continuer à bombarder l’Ukraine.Des frappes russes dans la nuit et tôt jeudi matin ont causé la mort d’un secouriste, perturbé le trafic ferroviaire et endommagé une synagogue, ont annoncé les autorités ukrainiennes. Deux journalistes ukrainiens de la chaîne Freedom TV ont été tués jeudi par un drone russe à Kramatorsk, dans l’est de l’Ukraine, a appris l’AFP auprès de leur média.