Nouvelle manifestation à Téhéran, craintes d’une répression brutale

Des Iraniens ont défilé samedi soir à Téhéran et scandé des slogans hostiles au pouvoir, malgré les craintes grandissantes de répression brutale dans le pays coupé du monde par un blocage d’internet.Des ONG ont signalé des dizaines de morts depuis le début du mouvement il y a deux semaines, alors que la République islamique fait …

Nouvelle manifestation à Téhéran, craintes d’une répression brutale Read More »

Fresh protests in Iran as internet blackout persists

Anti-government chants filled the streets of Iran’s capital on Saturday night, as protesters pressed the biggest movement against the Islamic republic in more than three yearsdespite a deadly crackdown under cover of an internet blackout.Iran has blamed the United States for the demonstrations, which ignited in Tehran two weeks ago over economic hardship and have since fanned nationwide with calls for ousting the clerical authorities. Rights groups have reported dozens of deaths and expressed alarm on Saturday that authorities were intensifying the crackdown.Little information is filtering out after an internet shutdown, with monitor NetBlocks showing virtually no connectivity since Thursday.US President Donald Trump said his country was “ready to help” the movement, after warning Iran was in “big trouble” over its efforts to suppress the protests. “Iran is looking at FREEDOM, perhaps like never before. The USA stands ready to help!!!” Trump posted on Truth Social Saturday. According to the New York Times, Trump was recently briefed on options for possible military strikes.US officials, speaking to the Times anonymously, said Trump has not yet made a final decision about another intervention, after Washington joined Israel’s 12-day war against the Islamic republic in June. Crowds gathered again on Saturday in the north of the Iranian capital, setting off fireworks and banging pots as they shouted slogans in support of the ousted monarchy, according to video verified by AFP. Other videos, that AFP could not immediately verify, showed demonstrations in other parts of the capital where protesters shouted anti-government slogans.Reza Pahlavi, the US-based son of Iran’s deposed shah, urged Iranians to stage more targeted protests over the weekend.”Our goal is no longer just to take to the streets. The goal is to prepare to seize and hold city centres,” Pahlavi said in a video on social media.The demonstrations have posed one of the biggest challenges to the theocratic authorities who have ruled Iran since the 1979 Islamic revolution.After initially calling for “restraint” and acknowledging economic grievances, they have since hardened their stance. Supreme leader Ayatollah Ali Khamenei, in a defiant speech on Friday, lashed out at “vandals” doing Trump’s bidding.- ‘Not safe’ -Amnesty International said it was analysing “distressing reports that security forces have intensified their unlawful use of lethal force against protesters” since Thursday.Norway-based Iran Human Rights group has said at least 51 people have been killed in the crackdown so far, warning the actual toll could be higher.It posted images it said were of bodies of people shot dead in the protests on the floor of Alghadir hospital in eastern Tehran. “These images provide further evidence of the excessive and lethal use of force against protesters,” IHR said. On Friday in Tehran’s Saadatabad district, protesters chanted anti-government slogans including “death to Khamenei” as cars honked in support, a video verified by AFP showed. Other images disseminated on social media and by Persian-language television channels outside Iran showed similarly large protests elsewhere in the capital, as well as in the eastern city of Mashhad, Tabriz in the north and the holy city of Qom.In the western city of Hamedan, a man was shown waving a shah-era Iranian flag featuring the lion and the sun. The same flag briefly flew over the country’s embassy in London after protesters reached the building’s balcony, witnesses told AFP. On Thursday and Friday, an AFP journalist in Tehran saw streets deserted and plunged into darkness. “The area is not safe,” said a cafe manager as he prepared to close the shop around 4:00 pm. – ‘Price to pay’ -Authorities say several members of the security forces have been killed, and state television aired images on Saturday of funerals for several members of the security forces killed in the protests, including a large gathering in the southern city of Shiraz.It also aired images of buildings, including a mosque, on fire.Iran’s army said in a statement that it would “vigorously protect and safeguard national interests” against an “enemy seeking to disrupt order and peace”.Global leaders have urged restraint from Iranian authorities, with European Union chief Ursula von der Leyen saying Europe backed Iranians’ mass protests and condemned the “violent repression” against the demonstrators.On Saturday, the start of the working week in Iran, one man in Tehran said he was unable to check his work email.”This is the price to pay before the victory of the people,” he said.

Maduro depuis sa prison dit aller “bien”, les Américains invités à quitter “immédiatement” le Venezuela

Le gouvernement des Etats-Unis a appelé samedi ses ressortissants à quitter “immédiatement” le Venezuela en raison d’une situation sécuritaire jugée instable, une semaine après la capture de Nicolas Maduro qui, depuis sa prison à New York, a dit aller “bien”.”Nous allons bien. Nous sommes des combattants”, a déclaré le président vénézuélien déchu depuis le centre de détention de Brooklyn, à New York, selon son fils dans une vidéo publiée samedi par le parti au pouvoir au Venezuela.Accusés notamment de trafic de drogue, Nicolas Maduro et la Première dame Cilia Flores, qui ont plaidé non-coupable lors de leur présentation lundi devant la justice américaine, sont incarcérés depuis aux Etats-Unis avant une prochaine audience le 17 mars.Avec des pancartes proclamant “Nous voulons leur retour”, un petit millier de sympathisants ont défilé samedi dans les rues de Caracas, scandant “Maduro et Cilia sont notre famille!” “Ici, il y a un peuple qui se bat”, dit dans le cortège Yusleidys Arroyo, 36 ans. Les appels à manifester en soutien au dirigeant socialiste déchu sont quotidiens depuis l’opération militaire américaine du 3 janvier. La mobilisation était moindre samedi, où aucune figure du Parti au pouvoir, le PSUV, n’était présente pour haranguer les foules. Peut-être aussi par lassitude de ces rassemblements quotidiens.La manifestation coïncidait également avec l’anniversaire de l’investiture de Maduro pour un troisième mandat, à l’issue des élections de 2024 dénoncées par l’opposition comme frauduleuses. La télévision publique a diffusé une visite de la présidente par intérim Delcy Rodriguez à une foire agricole à Petare, un quartier emblématique de Caracas où s’est également tenue une petite manifestation en faveur de Maduro.”Nous n’allons pas nous reposer une seule minute tant que nous n’aurons pas récupéré le président”, a lancé Rodriguez. “Nous allons le sauver, bien sûr que oui”.- “Contact étroit” -Dans la foulée de la chute surprise de Maduro, l’ancienne vice-présidente Delcy Rodriguez a été investie présidente par intérim, et négocie sur plusieurs fronts avec Washington, qui souhaite notamment profiter des immenses réserves de pétrole vénézuéliennes.Son gouvernement a “décidé d’entamer un processus exploratoire” en vue de rétablir les relations diplomatiques avec les Etats-Unis, rompues depuis 2019.Après une visite de diplomates américains à Caracas vendredi, “l’administration Trump reste en contact étroit avec les autorités intérimaires”, indique samedi un responsable du département d’Etat. Donald Trump a affirmé avoir “annulé” une nouvelle attaque américaine sur le Venezuela du fait de la “coopération” de Caracas, et Washington entend “dicter” toutes ses décisions. Elle a rétorqué que son pays n’est ni “subordonné, ni soumis” à Washington.Samedi, le département d’Etat américain a enjoint tous ses ressortissants à ne pas voyager au Venezuela et ceux qui s’y trouvent à “quitter le pays immédiatement”, en raison d’une situation sécuritaire jugée “instable”.Il a évoqué la présence de “groupes de milices armées, connus sous le nom de colectivos, qui installent des barrages routiers et fouillent des véhicules à la recherche de preuves de citoyenneté américaine ou de soutien aux Etats-Unis”.- Une vingtaine de libérations -L’alerte américaine “repose sur des récits inexistants visant à créer une perception de risque qui n’existe pas”, a rétorqué Caracas dans un communiqué, ajoutant que “le Venezuela jouit d’un calme, d’une paix et d’une stabilité absolus”.”Le Venezuela a commencé, DE MANIERE SPECTACULAIRE, à libérer ses prisonniers politiques. Merci !”, a commenté samedi Donald Trump sur sa plateforme Truth Social, en référence à l’annonce jeudi par le président du Parlement Jorge Rodriguez, frère de Delcy Rodriguez, de la libération de “nombreux prisonniers”. Depuis, des dizaines de familles d’opposants ou militants vivent dans l’angoisse et l’espoir de retrouver leurs proches. Certains campent jour et nuit devant des centres pénitentiaires comme celui de l’Hélicoïde, une prison redoutée et gérée par les services de renseignements, ou celui de Rodeo I, à l’est de Caracas. Là, des proches devaient allumer des bougies et prier en tenant des pancartes avec le nom des leurs emprisonnés, a constaté l’AFP.Des ONG et l’opposition font état à ce stade de 21 libérations. sur un total de détenus qui oscille entre 800 et 1.200 selon les estimations d’ONG et d’organisations.bur-pr-al-lab/roc/gmo

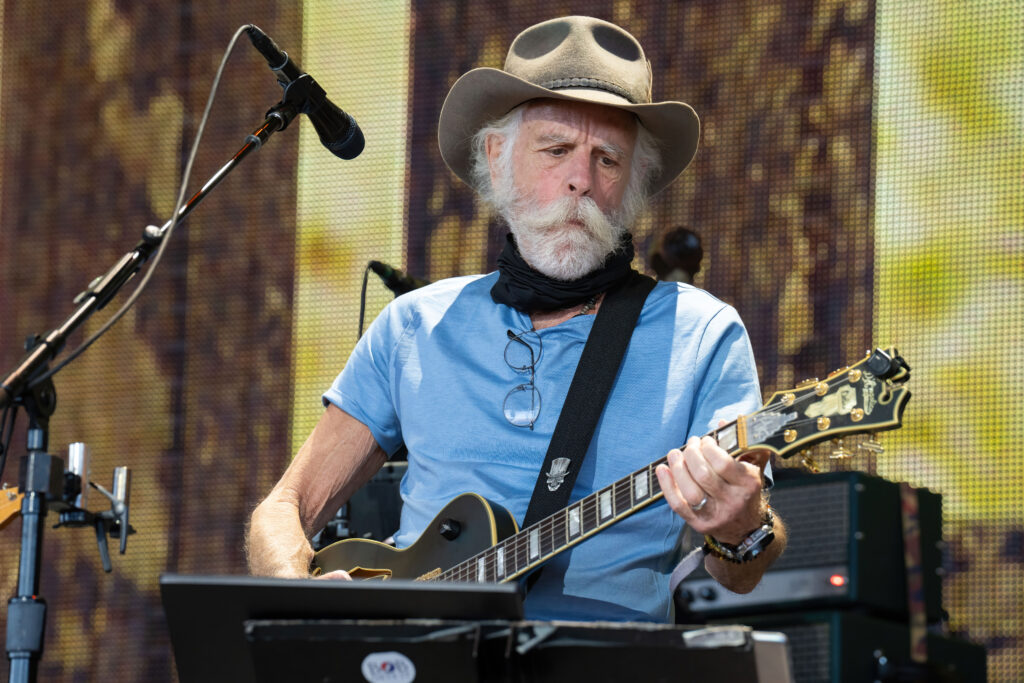

Grateful Dead co-founder and guitarist Bob Weir dies aged 78

American guitarist and songwriter Bob Weir, a founding member of the revolutionary, psychedelic jam band Grateful Dead, has died aged 78, his family announced Saturday.Weir was diagnosed with cancer in July and had beaten the disease, but “succumbed to underlying lung issues,” his family said in a statement on his personal website, without specifying where or when he died.”For over sixty years, Bobby took to the road,” the statement said. “Bobby will forever be a guiding force whose unique artistry reshaped American music.””His work did more than fill rooms with music; it was warm sunlight that filled the soul, building a community, a language, and a feeling of family that generations of fans carry with them.”Founded in San Francisco by Weir, Jerry Garcia, Ron “Pigpen” McKernan, Phil Lesh, and Bill Kreutzmann, the Grateful Dead became one of the leading music groups to emerge from the 1960s counterculture movement.With its trademark improvisational, genre-blending style, the band became known for never performing the same show twice, winning an avid and diverse legion of fans, and selling millions of records.The group revolutionized fan engagement, as followers — famously known as “Deadheads” — recorded and swapped bootleg tapes of the concerts in a communal, drug-addled camp environment that traveled from stadium to stadium, a trend later copied by other bands’ fandoms.The rockers disbanded in 1995, a few months after lead guitarist Garcia’s death at the age of 53, and a year after the group was inducted into the Rock & Roll Hall of Fame.Weir would however continue to perform intermittently with other living bandmembers, more recently in the group Dead & Company, which also included guitarist and singer John Mayer.”As we remember Bobby, it’s hard not to feel the echo of the way he lived,” the family said.”A man driftin’ and dreamin’, never worrying if the road would lead him home. A child of countless trees. A child of boundless seas,” the family said, quoting the songs “Cassidy” and “Lost Sailor,” written by Weir and the late John Perry Barlow.Following Weir’s death, 79-year-old drummer Kreutzmann became the last living co-founder of the Grateful Dead.Bassist Lesh died in October 2024 at the age of 84, while keyboardist McKernan died aged 27 in 1973.Drummer Mickey Hart, 82, joined the group in 1967.In 2024, the final year of Joe Biden’s presidency, Weir and other living Grateful Dead members were given Kennedy Center Honors, among the highest American arts awards.”The Grateful Dead has always been about community, creativity, and exploration in music and presentation,” Weir, Hart, Lesh and Kreutzmann said at the time.”Our music belongs as much to our fans, the Dead Heads, as it does to us. This honor, then, is as much theirs as ours.”