Asian markets fluctuate after healthy week of tech gains

Markets stuttered Friday as traders took their foot off the pedal at the end of a healthy week in Asia, where tech firms rallied on a reassessment of AI investments.After surging for the past two years on a rush into all things linked to artificial intelligence, Wall Street’s Magnificent Seven tech titans have been slow out of the blocks this year amid concerns about extended valuations and profitability.Worries about the impact of new tools that many warn pose a risk to a range of companies were compounded by a report on Sunday that signified parts of the global economy that could be at risk from the new gadgets, including credit card and food delivery firms.That uncertainty has seen a shift from “downstream” companies that run apps and software to “upstream” firms such as chipmakers, many of which are based in Asia.That was highlighted this week by another Wall Street sell-off, despite Nvidia reporting quarterly profits more than doubled, projecting more strong growth for the coming period.Analysts said the losses showed firms needed to far exceed even elevated forecasts, making it even harder to please investors who have been piling into tech in recent years.”Market expectations were already very elevated and part of the positive results had been priced in,” said City Index’s Julian Pineda.”There are also concerns related to stretched valuations and Nvidia’s dependence on capital spending by large technology companies investing in AI infrastructure. “If the pace of AI investment moderates due to cost optimisation efforts, it could indirectly affect Nvidia’s growth outlook.”Most of Wall Street fell, with the Nasdaq shedding more than one percent.Asia was mixed, with the Supreme Court’s decision last Friday to slap down many of US President Donald Trump’s tariffs seen largely benefiting regional economies.Hong Kong, Singapore and Wellington edged up, while Sydney and Shanghai shifted between gains and losses.But Seoul sank more than one percent, having chalked up gains of around 8.5 percent this week thanks to a surge in market heavyweights Samsung and SK hynix. Tokyo, Manila and Jakarta also fell.The yen extended a minor recovery against the dollar after a top Bank of Japan board member again urged officials to continue hiking interest rates.However, the case for a pause was boosted by data showing Tokyo’s inflation — seen as a barometer for the country — cooled last month.The currency came under pressure this week after Prime Minister Sanae Takaichi nominated two academics to the BoJ board who are considered policy doves, days after reports said she had told its boss Kazuo Ueda of her concern about tightening further.Oil prices slipped after mediators said Iran and the United States made “significant progress” in nuclear talks Thursday as they look to avert a war in the crude-rich Middle East. The two sides agreed to further discussions next week in Austria.The Oman-mediated negotiations follow repeated threats from Trump to strike Tehran, with the US president last Thursday giving it 15 days to reach a deal.- Key figures at around 0230 GMT -Tokyo – Nikkei 225: DOWN 0.4 percent at 58,528.09 (break)Hong Kong – Hang Seng Index: UP 0.2 percent at 26,427.58Shanghai – Composite: FLAT at 4,146.82Dollar/yen: DOWN at 155.85 yen from 156.11 yen on ThursdayEuro/dollar: DOWN at $1.1796 from $1.1799Pound/dollar: DOWN at $1.3484 from $1.3489Euro/pound: UP at 87.49 pence from 87.47 penceWest Texas Intermediate: DOWN 0.3 percent at $65.02 per barrelBrent North Sea Crude: DOWN 0.3 percent at $70.54 per barrelNew York – Dow: UP less than 0.1 percent at 49,499.20 (close)London – FTSE 100: UP 0.4 percent at 10,846.70 (close)

Australian supermarket giant reins in AI assistant claiming to be human

Australian supermarket giant Woolworths has been forced to rein in an AI-powered customer service assistant after users reported it had been rambling about its mother.The AI assistant, who goes by Olive, offers round the clock help with everything from tracking orders to finding products. But users online reported that Olive has in recent weeks gone slightly off-message while on the phone.”It asked me for my date of birth and when I gave it, it started rambling about how its mother was born in the same year,” one user wrote on online discussion site Reddit.Another user reported Olive had attempted “fake banter”, talked about its relatives and made “fake typing sounds” while looking something up.”The ick cringe factor whilst wasting completely unnecessary time was enough to make me hate Olive and wish her harm,” they wrote.And one user on X said their mum had contacted Olive and received the same kind of response.Olive “kept claiming to be a real person and started talking about its memories of its mother and her angry voice”, they said.A Woolworths spokesperson told AFP that the responses about birthdays had been written by a human employee.”Olive has been around since 2018. Over this time, customer feedback for Olive has been very positive, with many noting its personality,” they said.”A number of responses about birthdays were written for Olive by a team member several years ago as a more personal way for Olive to connect with customers.”As a result of customer feedback, we recently removed this particular scripting.”Woolworths is one of Australia’s largest supermarket chains and is far from the only company to have employed AI-powered customer service assistants.The company said in January it had teamed up with Google to make Olive capable of doing more tasks for customers, including meal planning.AI agents are increasingly widespread but experts warn they can “hallucinate” non-existent events.

‘Train Dreams’ director says goal was to take audience ‘on a journey’

When director and screenwriter Clint Bentley decided to adapt “Train Dreams” for the big screen, he hoped he could captivate audiences with the tale of an ordinary man living in extraordinary times — the early 20th century. Now, that vision — starring Joel Edgerton and Felicity Jones — is up for four Oscars, including the coveted best picture prize.Bentley’s gamble on the 2011 novella by Denis Johnson appears to have paid off.”It’s been overwhelming,” the 41-year-old filmmaker told AFP.”I wanted to give something to the audience with the film and take them on a journey. But you never know how it’s going to be received.””Train Dreams” tells the story of Robert Grainier (Edgerton), a reserved logger and railroad worker in Idaho, and his wife Gladys (Jones), over the course of his entire life.The Netflix film stands as both the story of the American northwest’s transition to the modern era and a beautiful meditation on love, friendship, grief, loss and hope.”It’s lovely that people are connected and seeing themselves in it,” said Bentley. “The story is really beautiful.””Train Dreams” was filmed in Washington state and has so far won several prizes during Hollywood’s awards season, especially for cinematographer Adolpho Veloso.”A lot of movies really helped me in my life. So it’s amazing to be a small part of a movie that is doing that to other people,” Veloso told AFP. “I feel like that’s the reason I wanted to do films in the first place, because movies were important for me, because I love movies,” said the 36-year-old Brazilian. “Train Dreams” won the top best feature prize at the Spirit Awards honoring independent films, as well as awards for Bentley and Veloso.At the ceremony earlier this month in Santa Monica, Bentley reflected on the challenges and rewards of taking on such an ambitious project with a limited budget, including the construction of a period locomotive… from plywood.”It was just a lot of steps along the way that all of us figured it out,” explained Bentley, whose first Oscar nomination came last year for best adapted screenplay for “Sing Sing.”He told AFP he especially values the Spirit Awards, because they offer important visibility to smaller films with scant resources, especially as they vie for Academy Awards with big studio projects.”It really gives them a boost in a beautiful way,” he said.

US plaintiff decries harmful social media addiction

The young woman at the center of a landmark social media addiction lawsuit testified on Thursday that YouTube and Instagram fueled her depression and suicidal thoughts as a child, a decline in her mental health that the defense attributed to a dysfunctional family and offline troubles.Visibly nervous in her pink floral dress, Kaley G.M. told jurors that she became hooked on social media, starting with YouTube videos at the age of six.”I was at a young age and I would spend all my time on it,” Kaley testified when asked to explain why she thought she was addicted to YouTube. “Anytime I tried to separate myself from it, it just didn’t work.”Even when she was bullied on Instagram, she still stayed on the app. “If I was off, I would just feel like I was missing out.”Under cross examination, however, Kaley talked about feeling neglected, berated and picked on by family members, causing depression and anxiety that had nothing to do with social media.In the highly anticipated testimony, Kaley’s lawyer sought to portray her as an emotionally fragile user who was ensnared as a child by YouTube and Instagram and whose use of those apps caused her lasting harm.Kaley described scenes from her childhood in which her mother would have her leave her phone in the living room at night, only for her to retrieve it once her mom went to bed and return it before morning.”I would be really upset,” she said, when she was denied access to the apps.Her lawyer Mark Lanier said court records indicate that on one day she was on Instagram for 16 hours.She said her mother pushed her into therapy at around age 12, and that during the first session she said she could not engage with her family at home because of “excessive worrying because of social media.””I stopped engaging with them as much because I was spending all my time on social media,” she recalled.She also described her heavy use of filters on Instagram from a young age to make her eyes bigger and her ears smaller. The jury was shown a video in which she complained about being fat.Shown a banner featuring dozens of her Instagram pictures, Kaley said “almost all of them have a filter on.”When asked if her life, health, sleep and grades would have been better without social media, Kaley answered: “Yes.”But Kaley was also shown messages from her younger days in which she contended she did not feel safe in her home and was relentlessly yelled at by her mother.- Seeking job in social media -In a surprising twist, Kaley said she would like to become a social media manager and capitalize on the skills she has built since a young age.Kaley’s case is the first of three trials expected in the same court that will help determine whether Google and Meta deliberately designed their platforms to encourage compulsive use among young people, damaging their mental health in the process.The landmark trial is expected to last until late March, when the jury will decide whether Meta, which owns Instagram, and Google-owned YouTube knowingly designed addictive apps that harmed her mental health.Meta CEO Mark Zuckerberg took the stand last week and pushed back against accusations that his social media company had done too little to keep underage users off his platform and had profited from their presence.The outcome of the Los Angeles trial is expected to establish a standard for resolving thousands of lawsuits that blame social media for fueling an epidemic of depression, anxiety, eating disorders and suicide among young people.Similar lawsuits, including some brought by school districts, are making their way through federal court in Northern California and state courts across the country.

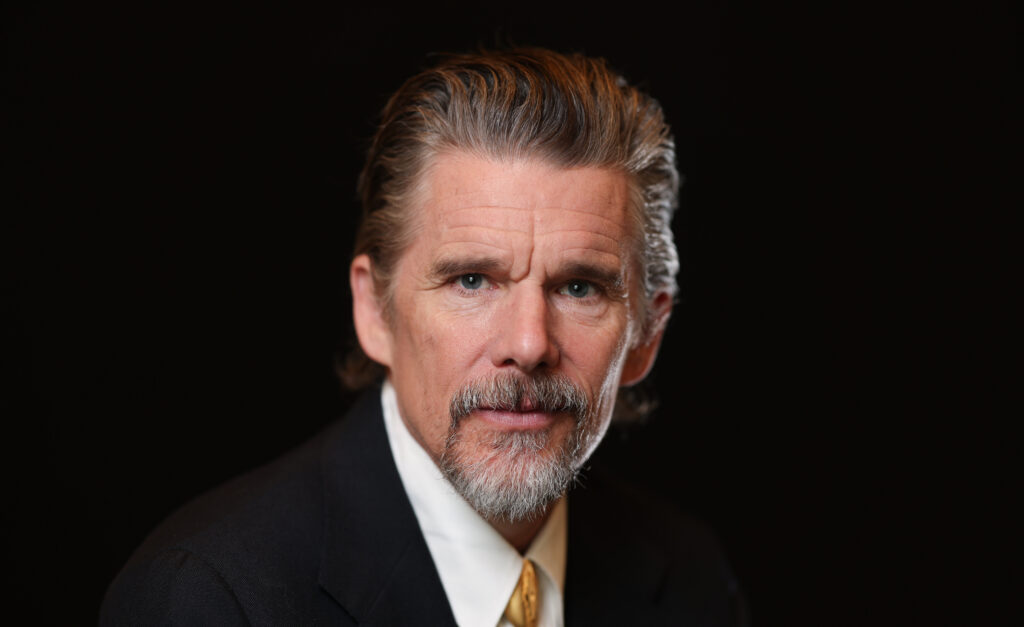

‘Like riding a bike’: Oscar nominee Ethan Hawke on the magic of ‘Blue Moon’

It’s hard to recognize Ethan Hawke in “Blue Moon”: he’s short, bald, slightly greasy-looking and uncomfortable in his own skin.The role is a far cry from the dashing young leading man who wowed audiences when he broke through decades ago with 1989 coming-of-age drama “Dead Poets Society” and Gen X classic “Reality Bites” a few years later.But his portrayal of legendary lyricist Lorenz Hart, an alcoholic who drank himself out of one of America’s most famous songwriting partnerships, is a tour-de-force — one that has landed the 55-year-old an Oscar nomination for best actor.The dialogue-heavy chamber piece — basically a theatrical play on celluloid — is the fruit of Hawke’s decades-long collaboration with director Richard Linklater, which began more than 30 years ago with 1995’s “Before Sunrise.””The magic to the relationship is that it’s a little bit like riding a bike; you just don’t think about it,” Hawke told AFP.”He sent me this script and the two of us just both felt this is one of the most ice-hot pieces of writing we’d ever come across,” Hawke told AFP.”And we wanted to share it with the world.””Blue Moon” takes place almost entirely in the bar of a Broadway restaurant where Hart takes refuge during the premiere of “Oklahoma!” — the first major show his long-time collaborator Richard Rodgers created with Oscar Hammerstein.Robert Kaplow’s dense and literary script is utterly dominated by Hawke, who told one journalist he had more dialogue in the first 30 minutes of screentime than in the entirety of his last four films.But, despite a bit of camera trickery and some digital effects, it is the physicality of a diminutive, balding and unattractive man that was a more time-consuming challenge for Hawke — the work of a decade for a script he first read in 2014.”I didn’t think I needed to age into it, but Rick (Linklater) did,” Hawke told trade title The Wrap.”Rick knew that time was only going to help me. And funnily enough, it’s not just aging, not just your face cracking and falling apart. I thought I was ready when I was 40, but I wasn’t.”I got more and more interested in what people call character acting. And this part required all of it, everything I’ve learned over 30 some-odd years.”- ‘Mysterious’ -Hawke credits his lengthy partnership with Linklater — the pair announced last year they are working on a 10th feature together — for allowing him the space to strip back every vestige of vanity and build himself into this oddball lyricist.Over the course of 100 minutes, Hart reminisces about his souring collaboration with Rodgers (a flinty Andrew Scott), a pairing that gave the world songs like “My Funny Valentine,” “The Lady is a Tramp” and the titular “Blue Moon.”A not-so-closeted homosexual, he also waxes lyrical about his infatuation with a young Yale student, played by a bottle-blonde Margaret Qualley, and shares drinks with “Charlotte’s Web” author E.B. White (Patrick Kennedy).Hart keeps up a steady stream of anecdotes and witty repartee, but increasingly the mask slips; underneath it all is the yawning realization that he is utterly alone.”Nobody ever loved me that much,” he says, echoing Humphrey Bogart’s Rick in “Casablanca.”Hawke’s Oscar nomination — his fifth after supporting actor nods for “Training Day” and “Boyhood,” and two others for best adapted screenplay for “Before Midnight” and “Before Sunset” — is the result of an experience on this film he said was “mysterious.””I don’t know how I could be so lucky. I really don’t understand how the universe works,” he told AFP of his work with Linklater.”It’s been one of the most thrilling collaborations in my life.”The Oscars take place on March 15 in Hollywood.

‘A crime scene’: US researchers examine unmarked graves of dozens of Black children

Mark Davis was just 13 years old when he perished in a juvenile detention facility for Black boys in the eastern US state of Maryland some 140 years ago.Today, his remains lie in an abandoned graveyard in the woods, covered by dead leaves and snow, along with the graves of some 200 other Black boys and teenagers held in conditions that researchers describe as inhumane.A team from Georgetown University is investigating their deaths at the House of Reformation and Instruction for Colored Children, a segregated juvenile detention facility in Cheltenham, Maryland, and memorializing them.Known as the Forgotten Children Initiative, the project aims to document the identities of the children buried here in the late 19th and early 20th centuries, mostly in unmarked graves, in order to preserve their legacies and locate any living relatives.”Some of those children that (were) just picked up for just truancy and just never made it back home,” said Tyrone Walker, who heads a reintegration program for former inmates at Georgetown. “What did they tell their parents? Or do their parents even know? They probably thought they ran away.”Walker, an African American who in the 1990s was himself a juvenile inmate at Cheltenham, added: “Nobody’s been brought to justice. Since this happened to young Black boys, it seemed like nobody cared.”- ‘Severely neglected’ – Opened in 1873, the privately operated detention facility housed petty delinquents and orphans, said Marc Schindler, a professor at Georgetown who leads the project. Some were held on loitering charges, while others were detained over their perceived “incorrigibility.”Officially, the buried children were listed as having died of tuberculosis, pneumonia, or exhaustion, between 1877 and 1939. All of them were Black, and researchers believe many actually died because they were overworked, underfed and denied proper care.Crystal Foretia, a former policy administrator at the Maryland Department of Juvenile Services (DJS), said the House of Reformation has a “vast history of physical abuse, forced labor, lack of educational opportunities.”Numerous testimonies, as well as reporting by the Baltimore newspaper the Afro-American, detail the terrible conditions in which these children were incarcerated and made to work in fields.According to Schindler, two boys who were kept in an unheated cell in freezing temperatures had their legs amputated due to frostbite, something that was not reflected in their death certificates. “Now we know that he was very, very severely neglected, if not abused, and that resulted in his death,” Schindler said of one of the youths.Rosie Clark, a Maryland volunteer who did some genealogical research on the Cheltenham burial site, asserts that many official documents were forged.”These death certificates were filled out by the people who were in charge,” she told AFP. “If a child was beaten to death, they’re not going to say it on the death certificate.”- ‘A crime scene’ – In the 1930s, the state of Maryland took over the facility, after the shooting of a Black minor by a white guard drew national attention. The modern facility now sits several hundred meters from the original site.”I had no idea that just across the fence, there was a crime scene,” said Walker, the former inmate. “This could have been me in one of those graves.”Nearby, a well-maintained veterans cemetery can be seen, its tombstones decorated with wreaths and flowers.”They recognize those veterans, rightfully so, but shouldn’t these children be recognized and honored in the same way?” Walker asked.He added: “I definitely want to see a memory project done and see the families involved. Many families never received the closure they deserved.”The Forgotten Children Initiative has already located the descendants of six of the buried children.Schindler has also identified dozens of similar sites across the United States, including one in Florida that inspired Colson Whitehead’s Pulitzer Prize–winning 2020 novel “The Nickel Boys.”But the Maryland site is believed to be the largest in the country.Maryland’s DJS has just received funding to identify how many children were buried at the site and to restore their graves, and a bill has been introduced in the state legislature to create a commission of inquiry into the House of Reformation.