Bill Clinton denies wrongdoing at grilling on Epstein ties

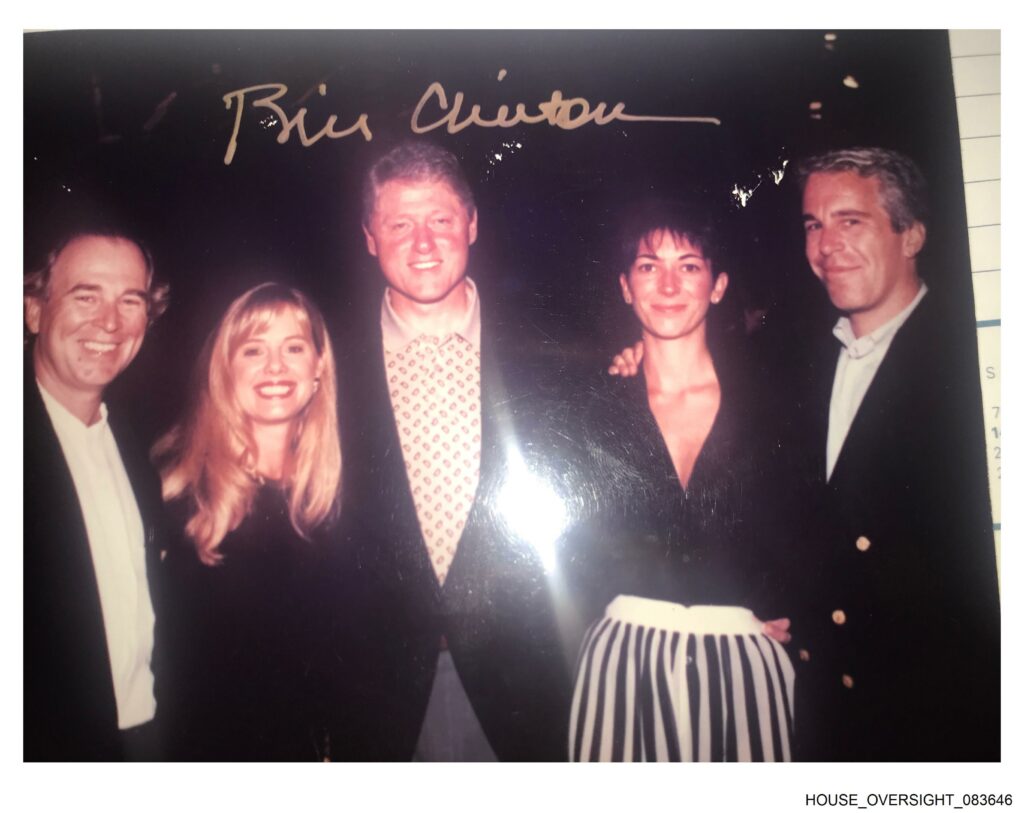

Former US president Bill Clinton denied wrongdoing Friday to a congressional panel probing his links to Jeffrey Epstein, before calling on others to testify as Democrats seek to shift focus onto Donald Trump’s ties to the sex offender.Clinton features prominently in the Epstein files but insists that he broke ties well before the disgraced billionaire’s 2008 conviction for sex offenses.”I saw nothing, and I did nothing wrong,” Clinton said in his opening statement, shared on social media. The Republican chair of the House committee probing Epstein, James Comer, said “we believe this was a very productive deposition that President Clinton answered every question — or attempted to answer every question.”Comer’s Republican colleague Nancy Mace alleged there were “inconsistencies” in his testimony without providing specific examples.Democrats on the committee have reiterated their call for Trump, who also has well-documented links to Epstein, to be quizzed.”Let’s be real, we are talking to the wrong president,” said Democratic committee member Suhas Subramanyam, who also emphasized that Clinton had not dodged any questions.In his statement, Clinton did not name Trump directly but said “no person is above the law, even presidents — especially presidents.” As for Trump, he repeated his skepticism over the whole process, telling reporters he likes Clinton “and I don’t like seeing him deposed.”In a video statement he posted late Friday on X, Clinton appeared to criticize the process in which he had been asked to testify but others had not, warning against the sharp partisan battles that have shaped the scandal.”I hope that by being here today, we can bring ourselves just a little further from the brink, and back to being a country where we can disagree civilly and we can search for truth and justice, and it outweighs the partisan urge to score points and create spectacle,” he said.”I hope it will motivate everyone to go in front of Congress to say what they know,” he said, without naming anyone.Being mentioned in the files released by the US Department of Justice does not imply wrongdoing and Clinton — like Trump — has not been accused of a crime or formally investigated.Clinton follows his wife, former secretary of state Hillary Clinton, who testified Thursday and defiantly called for Trump to appear before the panel.The lawmakers should ask Trump “directly under oath about the tens of thousands of times he shows up in the Epstein files,” she said.The depositions are being held behind closed doors, with Bill Clinton likening the proceedings to a “kangaroo court.” The couple has called for them to be open and televised.Hillary Clinton said she had never known Epstein or visited the properties where he hosted world celebrities and powerful business and political figures — as well as allegedly trafficking young women and girls.Bill Clinton has acknowledged extensive interactions with Epstein but said he never visited the financier’s infamous private Caribbean island.Epstein was convicted in 2008 for soliciting sex from girls as young as 14, but died in a New York jail cell in 2019 before he could be tried on sex trafficking charges. His death was ruled a suicide but like much else around Epstein is the subject of lurid conspiracy theories.The Clintons had initially rejected subpoenas ordering them to testify, but the Democratic power couple agreed to do so after House Republicans threatened to hold them in contempt of Congress.- ‘Turned him in’ -Democrats say the investigation is being weaponized to attack Trump’s political opponents rather than to conduct legitimate oversight.Previously unseen photographs from the files include one showing Bill Clinton reclining in a hot tub, part of the image obscured by a stark black rectangle.In another, Clinton is pictured swimming alongside a dark-haired woman who appears to be Epstein’s accomplice Ghislaine Maxwell.Bill Clinton has acknowledged flying on Epstein’s private plane several times in the early 2000s for Clinton Foundation-related humanitarian work.”Jeffrey Epstein was in the White House 17 times while Bill Clinton was President. We know that Bill Clinton flew on Jeffrey Epstein’s plane at least 27 times. So those are questions that we’re going to ask,” said Comer.Clinton said in his opening statement “not only would I not have flown on his plane if I had any inkling of what he was doing — I would have turned him in.”The depositions are being held in Chappaqua, New York, home to the Clintons, where dozens of journalists and Secret Service officers have converged.