Bolivia candidate vows to scrap China, Russia lithium deals

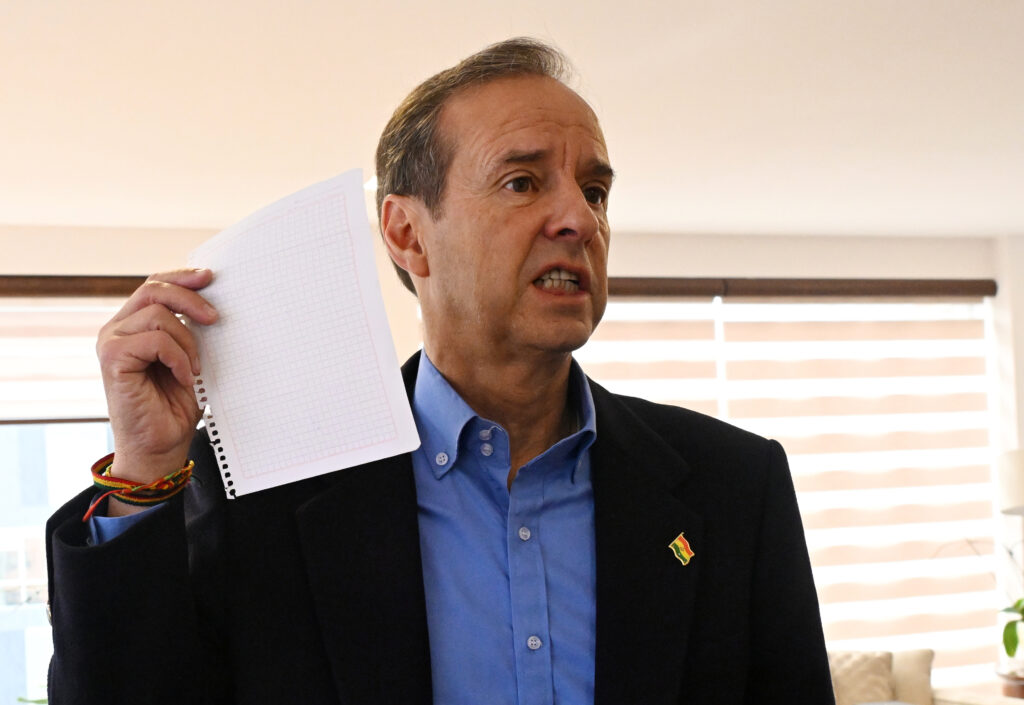

Bolivian right-wing presidential hopeful Jorge Quiroga on Monday vowed to scrap billion-dollar lithium extraction deals struck by the outgoing government with Russia and China if elected leader.”We don’t recognize (outgoing President Luis) Arce’s contracts… Let’s stop them, they won’t be approved,” the US-educated Quiroga, who has vowed a major shake-up in Bolivia’s alliances if elected president in October, told AFP in an interview.Quiroga came second in the first round of Bolivia’s August 17 presidential election with 26.7 percent, behind center-right senator Rodrigo Paz on 32 percent.The Movement Towards Socialism (MAS), in power since 2006, suffered a historic rout, with voters punishing the party founded by iconic ex-president Evo Morales over a deep economic crisis.Quiroga and Paz now face a second-round duel for the presidency on October 19.The fate of Bolivia’s lithium deposits — among the world’s largest of the metal used in smartphone and electric vehicle batteries — is a hot topic in the campaign.The so-called Lithium Triangle, spanning parts of Bolivia, Chile and Argentina, is home to 60 percent of the world’s lithium reserves, according to the US Geological Survey.But in the case of Bolivia, nearly all of it is still trapped underground, at an altitude of 3,600 meters (12,000 feet) in the vast Salar de Uyuni salt flat, one of the country’s top tourist attractions.In 2023 and 2024 Arce’s government signed deals with Russia’s Uranium One and China’s CBC, a subsidiary of battery manufacturer CATL, to extract lithium from the salt pan.Worth a combined $2 billion, the deals were intended to help Bolivia catch up in the race to mine the mineral.But they were blocked in Congress by infighting in the ruling party. Indigenous groups meanwhile went to court to have them scrapped on environmental grounds.Quiroga claimed Uranium One and CATL were selected “behind the back” of local authorities and said he would propose a new law on mineral deposits that precluded “favoritism.”- From gas to lithium -Bolivia enjoyed over a decade of strong growth under Morales (2006-2019), who nationalized the gas sector and ploughed the proceeds into anti-poverty programs.But underinvestment in exploration caused gas revenues to implode, eroding the government’s foreign currency reserves and leading to acute shortages of imported fuel, widely-used dollars and other basics.Inflation rose to 24.8 percent year-on-year in July, its highest level since at least 2008, causing voters to desert the left in droves.Quiroga, who served briefly as president in the early 2000s, has pledged a radical overhaul of Bolivia’s big-state economic model if elected, including steep spending cuts.His challenger Paz, who has campaigned as a moderate, on Monday ruled out strict austerity measures to rescue the country from the brink of bankruptcy.”There will be a stabilization process, we’re not calling it an adjustment,” the 57-year-old senator told AFP.He nonetheless revealed he would cut $1.2 billion in annual fuel subsidies — a major drain on the public purse — and save another $1.3 billion in unspecified “superfluous spending.”Paz added that he would create tax incentives to get Bolivians to bank any dollars hidden under their mattress but would not initially seek an international bailout, as proposed by Quiroga.”People understand that we have to get our house in order first,” said Paz, whose father Jaime Paz Zamora led Bolivia from 1989 to 1993.