Stocks steady as traders weigh inflation data, trade deal

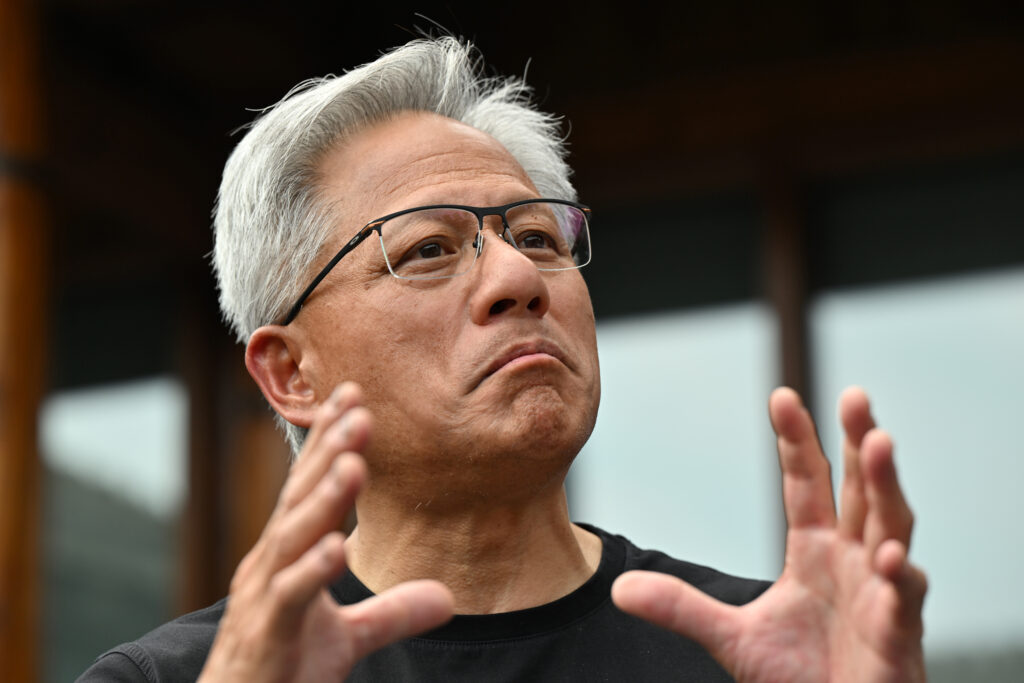

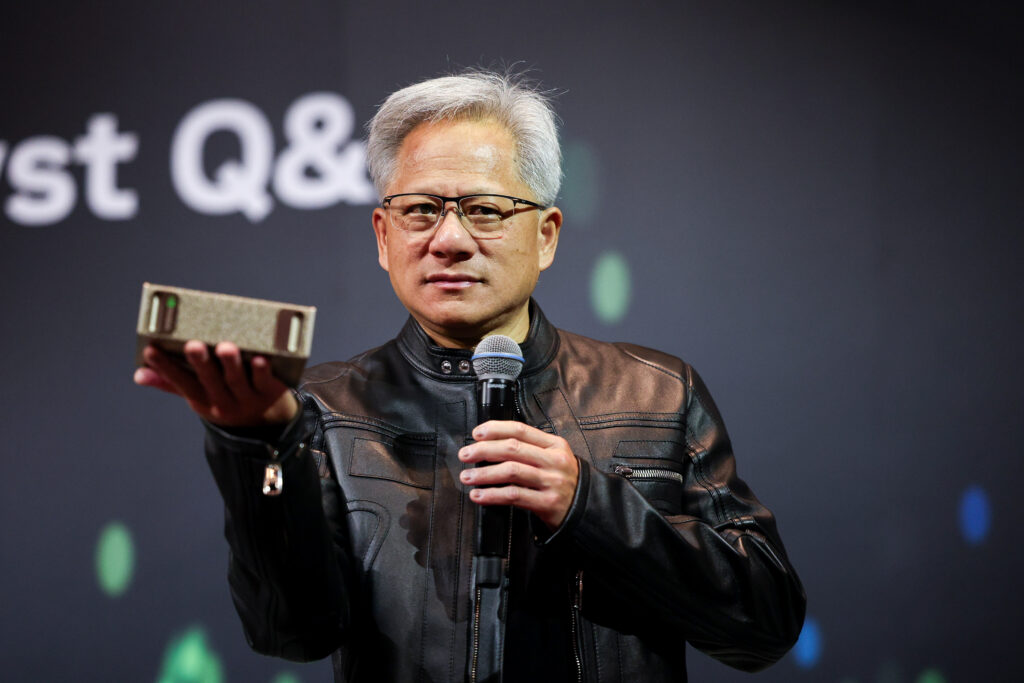

Major stock markets steadied on Wednesday as traders weighed a spike in US and UK inflation that raised concerns President Donald Trump’s tariffs could be feeding into the American economy.European markets and Wall Street showed modest gains as the latest data dampened the prospect of interest rate cuts by the US Federal Reserve, as an August 1 deadline looms for Trump’s latest tariff threat to several economies.”A higher-than-expected (June) inflation reading in the US… is one of the first data points to suggest tariffs are beginning to have some impact on prices,” noted AJ Bell investment analyst Dan Coatsworth.”While this impact looks fairly modest for now, this reading obviously comes before the more onerous levies on imports which are currently lined up for introduction at the beginning of August,” he added.Trump said a trade deal had been struck with Indonesia that will see the US impose tariffs of 19 percent on its goods, below the 32 percent previously threatened.Trump has now struck tariffs agreements with three countries, with around two dozen more in the pipeline ahead of August 1.While the Indonesia trade deal was welcomed, investor confidence was limited by data showing US inflation had jumped to 2.7 percent last month.”Signs of tariff-driven inflation are already starting to show, as some companies begin passing on higher costs to consumers,” said Ipek Ozkardeskaya, senior analyst at Swissquote Bank, in a note.”Fears of tariff-fuelled inflation and the continued strength in labour market data are pushing expectations of Fed rate cuts further out,” she added, saying the Fed was expected to hold rates at its July and September meetings.- EU talks, tech gains -The EU’s top trade negotiator Maros Sefcovic was jetting to Washington on Wednesday for talks with his US counterparts as the bloc renews its push to settle the transatlantic tariffs standoff.In Europe, shares in Renault tumbled 17 percent Wednesday, a day after the French car giant lowered its annual financial outlook.Renault did not specifically mention tariffs, despite the global auto sector being targeted by Trump.Trump on Tuesday warned that he could begin imposing tolls on imports of semiconductors and pharmaceuticals from August 1.Tech firms pared earlier strong gains Wednesday after US titan Nvidia said it would resume exports of key chips to China following Washington’s pledge to remove licensing curbs.California-based Nvidia, one of the world’s most valuable companies, said Tuesday it would restart sales of its H20 artificial intelligence semiconductors to China, having been stopped by Trump’s tightened export licensing requirements in April.CEO Jensen Huang said they would be shipping “very soon”.Wall Street’s tech-heavy Nasdaq index inched up further Wednesday after a new record high on Tuesday.- Key figures at around 1340 GMT -London – FTSE 100: UP 0.2 percent at 8,969.42 pointsParis – CAC 40: FLAT at 7,770.60Frankfurt – DAX: UP 0.5 percent at 24,172.99Tokyo – Nikkei 225: FLAT at 39,663.40 (close)Hong Kong – Hang Seng Index: DOWN 0.3 percent at 24,517.76 (close)Shanghai – Composite: FLAT at 3,503.78 (close)New York – Dow: UP 0.4 percent at 44,185.64 pointsNew York – S&P 500: UP 0.2 percent at 6,255.99New York – Nasdaq Composite: FLAT at 20,696.12Euro/dollar: UP at $1.1577 from $1.1606 on TuesdayPound/dollar: UP at $1.3375 from $1.3383Dollar/yen: DOWN at 148.83 yen from 148.85 yenEuro/pound: DOWN at 86.53 pence from 86.69 penceWest Texas Intermediate: DOWN 0.6 percent at $66.71 per barrelBrent North Sea Crude: DOWN 1.15 percent at $67.92 per barrelburs-bcp/rlp/jj