Asian markets drop as Trump’s tariff deadline looms

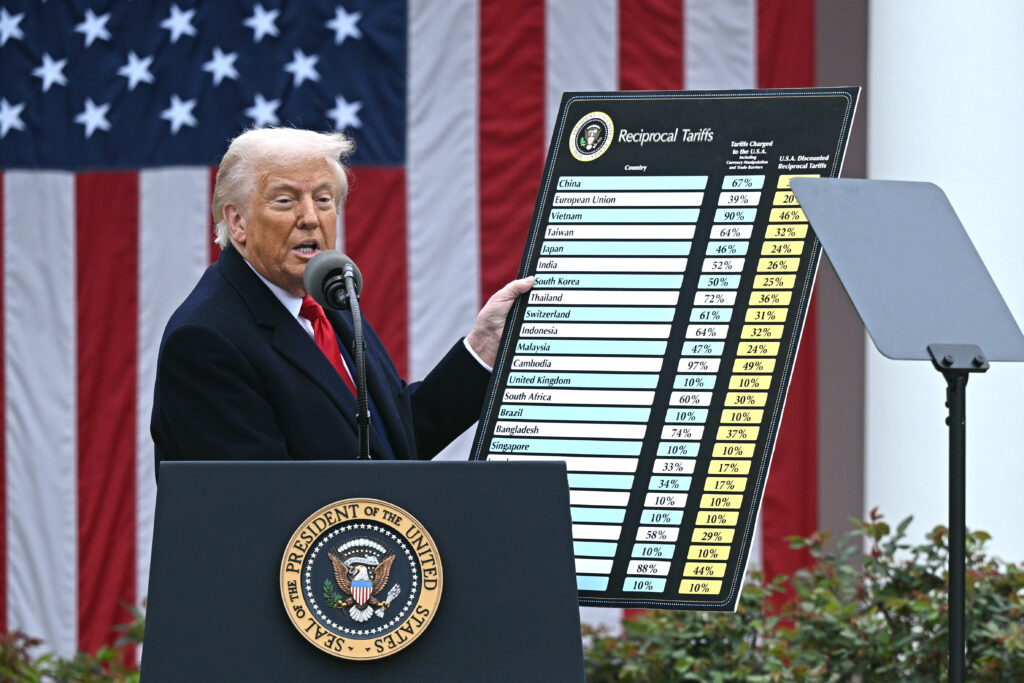

Most Asian markets fell Monday as countries fought to hammer out trade deals days before Donald Trump’s tariff deadline, though investors took heart after he said the levies would not kick in until the start of next month.While the White House has said several deals were in the pipeline, only two have been finalised ahead of the July 9 cut-off set by the US president.Governments from major trading partners including Japan, India, the European Union and South Korea have fought for the past three months to get agreements.But Trump said he will send his first tariff letters at 1600 GMT Monday, setting out what Washington will charge for doing business with the United States.He said an extra 10 percent would be added to any country “aligning themselves with the Anti-American policies of BRICS”, an 11-member alliance including Brazil, Russia, India and China.The announcement came after leaders of the group warned Trump’s “indiscriminate” import tariffs risked hurting the global economy.The deadline for a deal is Wednesday, but Treasury Secretary Scott Bessent confirmed on Sunday that the measures would not be applied until August 1.”It’s not a new deadline. We are saying, this is when it’s happening. If you want to speed things up, have at it. If you want to go back to the old rate, that’s your choice,” Bessent told CNN.He said the rates will then “boomerang back” to the sometimes very high levels Trump announced on April 2, before the president suspended the levies to allow for trade talks. “I would expect to see several big announcements over the next couple of days,” Bessent said. The president told reporters Sunday on Air Force One that “I think we’ll have most countries done by July 9, either a letter or a deal”, adding that some deals have already been made.Tariff uncertainty weighed on equity markets, with Tokyo, Hong Kong, Shanghai, Sydney, Wellington and Taipei all down, though there were small gains in Singapore, Seoul, Manila and Jakarta.Wall Street was closed Friday for a holiday.”Whether deadlines get extended remains uncertain given Trump’s unpredictable style,” said IG market analyst Fabien Yip. “Our base case expects several important trade partners to agree on a high-level basis before the deadline.”This would provide more time for detailed discussions over the following two months. The other risk factor is sector-specific tariffs covering semiconductors, pharmaceuticals, and materials may also be announced in due course.”Oil prices sank after Saudi Arabia, Russia and other major producers in the OPEC+ alliance said they would boost output far more than expected in August, fuelling demand worries just as Trump’s tariffs are about to begin.The group said “a steady global economic outlook and current healthy market fundamentals, as reflected in the low oil inventories” led to the decision to further hike output. – Key figures at around 0230 GMT -Tokyo – Nikkei 225: DOWN 0.5 percent at 39,628.41 (break)Hong Kong – Hang Seng Index: DOWN 0.3 percent at 23,842.39Shanghai – Composite: DOWN 0.1 percent at 3,467.81West Texas Intermediate: DOWN 1.8 percent at $65.81 per barrelBrent North Sea Crude: DOWN 1.0 percent at $67.61 per barrelEuro/dollar: DOWN at $1.1773 from $1.1783 on FridayPound/dollar: DOWN at $1.3634 from $1.3641Dollar/yen: DOWN at 144.51 yen from 144.53 yenEuro/pound: DOWN at 86.34 pence from 86.37 penceNew York: Closed for a public holidayLondon – FTSE 100: FLAT at 8,822.91 (close)