Leading garment producer Bangladesh holds crisis talks on US tariffs

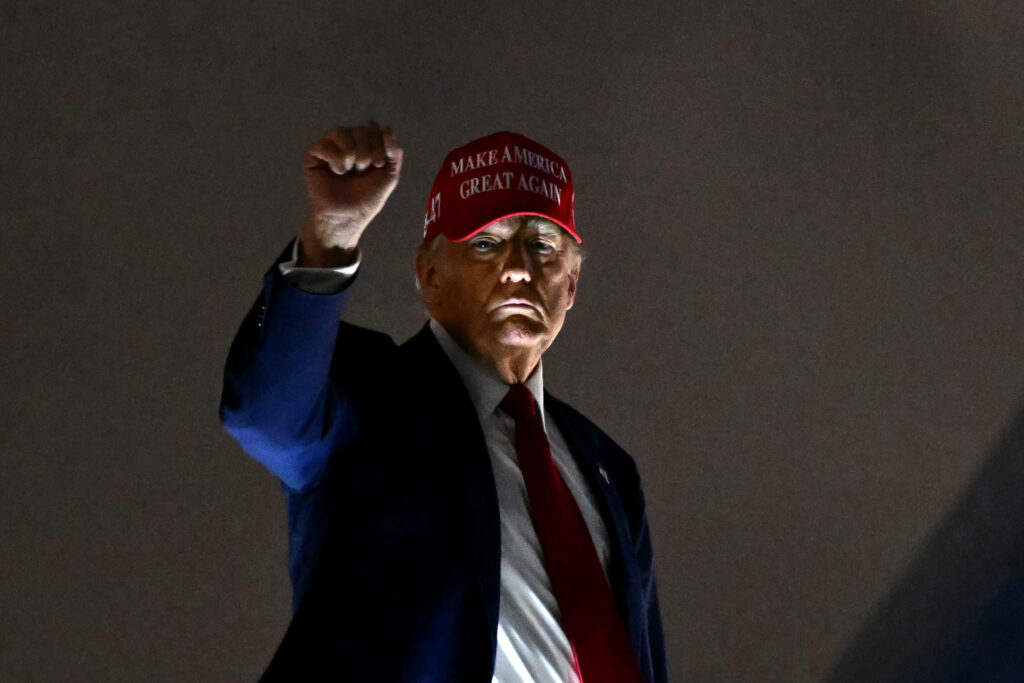

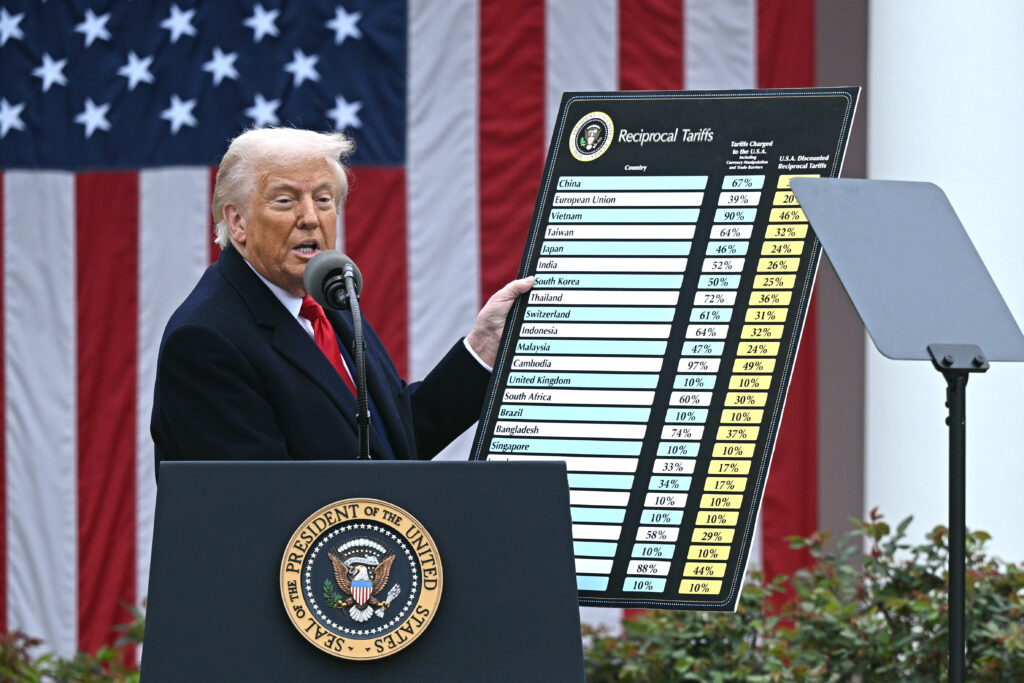

Bangladesh’s interim leader called an emergency meeting on Saturday after textile leaders in the world’s second-largest garment manufacturing nation said US tariffs were a “massive blow” to the key industry.Textile and garment production accounts for about 80 percent of exports in the South Asian country, and the industry has been rebuilding after it was hard hit in a revolution that toppled the government last year.US President Donald Trump on Wednesday slapped punishing new tariffs of 37 percent on Bangladesh, hiking duties from the previous 16 percent on cotton and 32 percent on polyester products.Bangladesh exports $8.4 billion of garments annually to the United States, according to data from the Bangladesh Garment Manufacturers and Exporters Association (BGMEA), the national trade body.That totals around 20 percent of Bangladesh’s total ready-made garments exports.Interim leader Muhammad Yunus “convened an emergency meeting… to discuss the US tariff issue,” the government said in a statement.Sheikh Bashiruddin, who holds the commerce portfolio in the government, told reporters after the meeting that Yunus “will raise the issue with the US administration”.Bashiruddin said he believed Bangladesh would “not be severely affected”, adding that some other competitors faced “much higher than those on us”.Yunus’ senior advisor Khalilur Rahman said the government had been readying for the tariff hike, and had began talks with US officials in February.”I have already spoken with several State Department officials,” Rahman said on Saturday. “The discussions are ongoing. We will take the necessary steps based on these discussions.”Bangladesh’s tax authority, the National Board of Revenue, is also expected to meet to review the fallout from the tariffs.Rakibul Alam Chowdhury, chairman of RDM Group, a major manufacturer with an estimated $25 million turnover, said on Thursday that the industry would lose trade.”Buyers will go to other cost-competitive markets — this is going to be a massive blow for our industry,” he said.Several garment factories produce clothing for the US market alone.Anwar Hossain, administrator of the BGMEA, has told AFP that the industry was “not ready” for the tariff impact.Bangladesh, the second-largest producer after China, manufactures garments for global brands — including for US firms such as Gap Inc, Tommy Hilfiger and Levi Strauss.