Hong Kong firm offloads Panama ports after Trump pressure

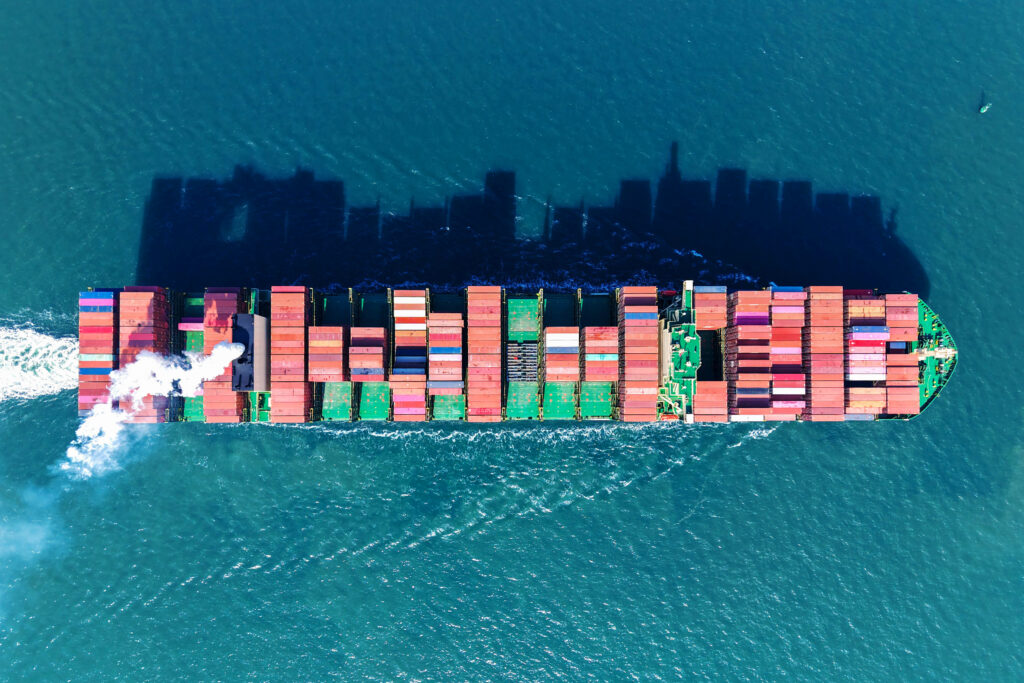

Under fierce pressure from US President Donald Trump, Hong Kong firm Hutchison said Tuesday it had agreed to sell its lucrative Panama Canal ports to a US-led consortium.CK Hutchison Holdings said it would offload a 90-percent stake in the Panama Ports Company (PPC) and sell a slew of other non-Chinese ports to a group led by giant asset manager BlackRock.The sellers will receive $19 billion in cash, the company said in a statement.Hutchison subsidiary PPC has for decades run ports at Balboa and Cristobal on the Pacific and Atlantic ends of the interoceanic waterway.But since taking office in January, Trump has complained that China controls the canal — a vital strategic asset that the United States once ran. “To further enhance our national security, my administration will be reclaiming the Panama Canal, and we’ve already started doing it,” he said in a speech to Congress Tuesday. “We’re taking it back.”Trump had refused to rule out a military invasion of Panama to regain control, sparking angry protests and a complaint to the United Nations by the Central American nation.In a joint press release with the buyers, Hutchison said the deal was motivated by business, not politics.”I would like to stress that the transaction is purely commercial in nature and wholly unrelated to recent political news reports concerning the Panama Ports,” co-managing director Frank Sixt said.”This transaction is the result of a rapid, discrete but competitive process in which numerous bids and expressions of interest were received,” said Sixt, who described the chosen agreement as “clearly in the best interests of shareholders.”BlackRock CEO Larry Fink said the transaction demonstrated his consortium’s capacity to “deliver differentiated investments for clients.””These world-class ports facilitate global growth,” he added.The Panamanian government, for its part, said the sale was “a global transaction, between private companies, driven by mutual interests.”It added that an audit launched into the PPC by the Panamanian comptroller’s office that oversees public entities will continue in spite of the sale.- 43 ports -The deal entails 43 ports comprising 199 berths in 23 countries.CK Hutchison Holdings is one of Hong Kong’s largest conglomerates, spanning finance, retail, infrastructure, telecoms and logistics.It is owned by Hong Kong billionaire Li Ka-shing.Shares in CK Hutchison soared 25 percent in Hong Kong on Wednesday after the sale was announced. In February, Marco Rubio visited Panama on his first overseas trip as secretary of state, proof of the canal’s importance to the new administration.Rubio won a commitment from Panamanian President Jose Raul Mulino to exit the Belt and Road Initiative, China’s signature infrastructure-building program.He also pressed for free passage of US vessels through the Panama Canal, which was denied.Since 1999, the canal has been run by the Panama Canal Authority (ACP) — an autonomous entity whose board of directors is appointed by Panama’s president and National Assembly. The 80-kilometer (50-mile) long canal handles five percent of global maritime trade, and 40 percent of US container traffic.Beijing has consistently denied interfering in the canal.