Trump heads for Asia and Xi trade talks

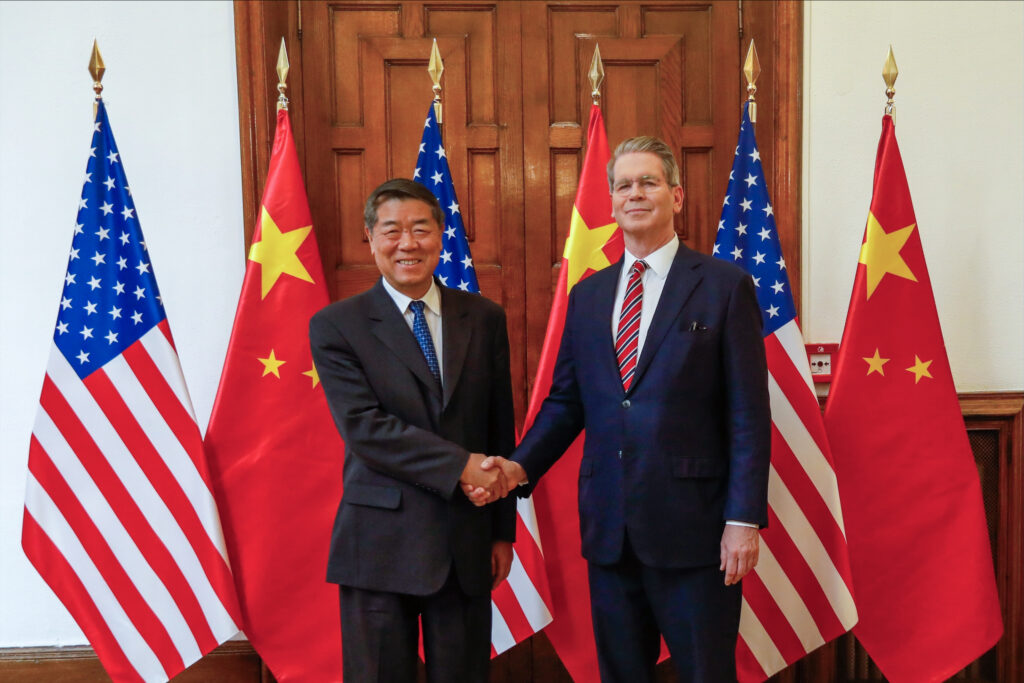

US President Donald Trump left on Friday for Asia and high-stakes trade talks with Chinese counterpart Xi Jinping — adding that he would also like to meet North Korean leader Kim Jong Un on his trip.Trump is set to meet Xi in South Korea on the last day of his regional swing in a bid to seal a deal to end the bruising trade war between the world’s two biggest economies. He will also visit Malaysia and Japan on his first trip to Asia since he returned to the White House in January in a blaze of tariffs and international dealmaking.A senior US official said on Friday that Trump would “deliver for the American people in one of the most economically vibrant regions of the world, signing a series of economic agreements.”As he left Washington, Trump added to speculation that while on the Korean peninsula he could meet Kim Jong Un for the first time since 2019 during his first presidency.”I’d like to, he knows we’re going there,” Trump told reporters at the White House. “We let him know, he knows that I’m going.”Talk about a possible meeting with Kim while Trump is in South Korea for a regional summit grew after Seoul’s reunification minister said there was a “considerable” chance.The White House had said earlier that a meeting was “not on the schedule.”- Peace and trade deals -Trump’s first stop will be Malaysia, where he arrives on Sunday, for the Association of Southeast Asian Nations (ASEAN) summit — a meeting Trump skipped several times in his first term.Trump is set to ink a trade deal with Malaysia, but more importantly he will oversee the signing of a peace accord between Thailand and Cambodia, as he continues his quest for a Nobel Peace Prize.Brazilian President Luiz Inacio Lula da Silva may also meet Trump on the sidelines of the summit to improve ties after months of bad blood, officials from both countries told AFP.Trump’s next stop will be Tokyo, where he arrives on Monday. He will meet conservative Sanae Takaichi, named this week as Japan’s first woman prime minister, on Tuesday.Japan has escaped the worst of the tariffs Trump slapped on countries around the world to end what he calls unfair trade balances that are “ripping off the United States.” – Trump and Xi -But the highlight of the trip is expected to be South Korea, with Trump due to land in the southern port city of Busan on Wednesday ahead of the Asia-Pacific Economic Cooperation (APEC) summit.Trump will meet South Korean President Lee Jae Myung, address an APEC lunch with business leaders and meet US tech bosses for dinner, on the sidelines of the APEC summit in the city of Gyeongju.On Thursday, Trump will meet Xi for the first time since his return to office.Global markets will be watching closely to see if the two men can halt the trade war sparked by Trump’s sweeping tariffs earlier this year, especially after a recent dispute over Beijing’s rare earth curbs.Trump initially threatened to cancel the meeting and imposed fresh tariffs over the critical minerals row, before saying he would go ahead after all.”The president is most interested in discussing the trade and economic relationship,” another senior US official said.Trump himself said on Thursday that the first topic on the agenda would be fentanyl, as he boosts pressure on Beijing to curb drug trafficking and cracks down on Latin American drug cartels.